The Fed, as expected, left their policy unchanged last night, but did tweak their language to acknowledge inflation is close to its 2% target, but not enough to change the "steady as she goes" path of three hikes for this year. After a rally attempt, US yields settled back into their current ranges, with the USD broadly following. In view of a lack of other alternatives, EM investments were in high demand.

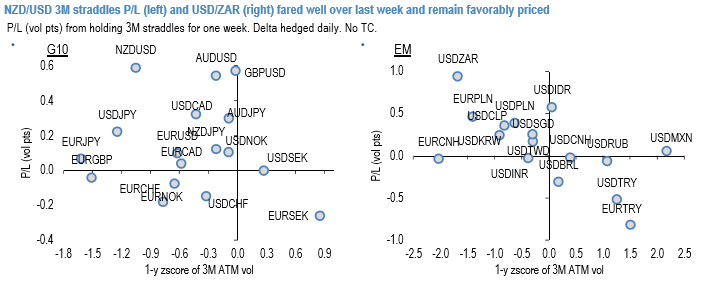

The above chart displays G10 and EM universe of 3M straddles, respectively. Unsurprisingly, high beta NZDUSD in G10 and USDZAR are two standout candidates with solid P/Ls over the past week. Both remain priced attractively (largely due to the favorably low vols prior to the ongoing vol rally).

USDJPY, a generic, catch-all risk off hedge, landed in the promising upper-left quadrant and screens cheap on implied vols (1.2 sigma below 10year average) but its skinny P/L and recently chronical realized vol underperformance makes as wary of yen gamma.

For the time being, we pass on EUR cross vols aiming for a more direct exposure. Finally, on the back of the heavy foreign bond ownership.

USDIDR straddles would have been attractive to own if it was not for the Indonesia central bank which indicated the intention to intervene if IDR continues to sell off.

Historically, short front/long back (e.g. -3M/+12M) USDIDR straddles calendars generated lucrative 5.5 vols annually (after transaction cost), though the structure is net short gamma posing risk from heavy drawdowns.

To short gamma in the current environment, one would need a decently high conviction that Bank Indonesia would indeed keep IDR spot under a watchful eye. With respect to strikes selection, the outperformance of OTM NZD call strikes relative to NZD puts is systematic (refer 2nd chart) making us favor OTM NZD calls over straddles.

We recommend buying delta hedged 3M 25D NZDUSD calls @8.05/8.375 and delta-hedged 3M USDZAR straddles @13.2/13.6vols, indic. Courtesy: JPM

FxWirePro launches Absolute Return Managed Program. For more details, visit:

European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary