The Federal Open Market Committee starts its next two-day policy meeting on March 14. US Non-farm Payrolls' solid reading on Friday reinforced market expectations of Fed rate hike in March. February jobs report removed the last obstacle for a Fed hike on Wednesday, in line with the message Fed Chair Yellen set in her recent speech.

Friday’s reading from non-farm Payrolls showed the economy added 235K jobs during February, although wage inflation slowed its pace. The unemployment rate edged down to 4.7 percent in February from 4.8 percent in January, in line with expectations. The report also said the annual rate of growth in average hourly employee earnings accelerated to 2.8 percent in February from 2.6 percent in January.

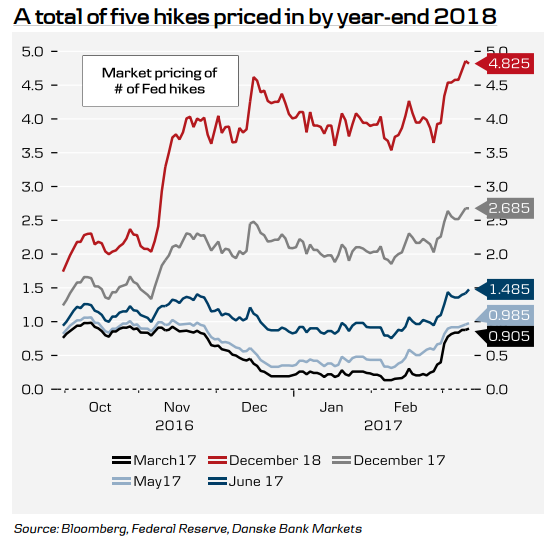

Markets have fully priced in an U.S. interest rate rise when the Federal Reserve meets this Wednesday, a view cemented by robust U.S. jobs data. Markets are also now more aggressive for the rest of the year, moving closer in line with the 'dot plot' indication of three hikes.

A Bloomberg survey of 45 economists conducted on March 7-8 showed three 25bps rate hikes by the Fed in 2017, with moves expected in March, June and December. Previous survey had revealed expectations for 2 hikes this year. The survey also showed economists lifting their average projections for the fed funds rate at the end of 2018 and 2019 by a quarter point, bringing those in line with Fed expectations as well.

Minutes from the previous Fed meetings revealed that FOMC members have become more vocal on their desire to reduce the Fed’s balance sheet in recent months. The Fed wants to begin the reduction when the normalization of the Fed funds rate is ‘well under way’, which seems to be when it is around 1.50 percent. Analysts feel the Fed will soon begin to discuss ‘the economic conditions that could warrant changes’ in the current reinvestment strategy ‘at upcoming meetings’.

"We expect the Fed to hike three times this year (March, July and December). We think the Fed will begin the reduction in Q1 18. An NY Fed survey shows that primary dealers expect it to begin a bit later in mid-2018," said Danske Bank in a report.

The U.S. Treasuries recovered Monday as investors covered previous short positions after reading upbeat labor market report on Friday. The yield on the benchmark 10-year Treasury fell 1 basis point to 2.57 percent, the super-long 30-year bond yield slipped 1-1/2 basis points to 3.15 percent and the yield on short-term 2-year note traded nearly 1 basis point lower at 1.35 percent by 1140 GMT.

EUR/USD was trading largely unchanged at 1.0674 at around 1230 GMT after hitting highs of 1.0714. USD/JPY was trading in a narrow range on the day, currently at 114.66. FxWirePro's Hourly Dollar Strength Index remained neutral at -49.8952 (a reading above +75 indicates a bullish trend, while that below -75 a bearish trend). For more details, visit http://www.fxwirepro.com/currencyindex.

China Holds Loan Prime Rates Steady in January as Market Expectations Align

China Holds Loan Prime Rates Steady in January as Market Expectations Align  BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary