Hawkish DM monetary policy surprises this week may spur 1-2 weeks of decent realized volatility but are unlikely to be durable enough to upend placid option pricing through the summer.

Option implied USD-correlations are near multi-year lows of a disciplined long-term range, which has historically signaled a flat-lining of prevailing USD trends for the next two months. Fade historically low EURUSD vs. TRYUSD correlations via weighted EURUSD vs. EURTRY 1Y vol spreads.

While USD-based correlations implied by FX options are testing multi-year lows.

There were some stirrings of life in FX options markets this week, helped by two developments that have potentially taken us one step closer to a pause in the never-ending stretch of vol declines since the beginning of the year.

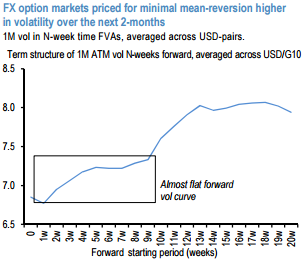

First, with the passage of the June FOMC, the last major event risk of the month is out of the way, and there is precious little event risk premium left to squeeze out of the front-end vols. On a forward basis, vol curves are almost flat – the average USD/G7vol curve prices in only a measly 0.4 vols of recovery in 1M ATMs over the next two months from current bargain basement levels in the high-6s (refer above chart) – reflecting a market priced for the onset of summer doldrums.

Second, DM monetary policy took a surprisingly hawkish turn this week, with the Fed, BoE, and BoC all catching markets off guard. Coming against the backdrop of solid YTD risk-asset performance and underwhelming macro fund manager returns (HFR Macro/CTA Index +0.6% YTD), it would not be surprising to see risk management considerations spark a round of profit taking on carry /EM positions over the coming 1-2 weeks, and placid option pricing for the very short-expiries may not be consistent with the potential for reasonable realized volatility over this period.

China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate