To precisely stating, it is going to be downtrend until it touches 89.347 levels which is at the lower trendline of falling wedge. More précising stating expect downswings in short term trend, bounce back likely in medium term but needs to be confirmed with other indicators. With this technical reasoning, we recommend arresting further downside risks of this pair and enjoy returns even during falling markets.

Speculate with credit call spreads:

On speculation grounds, buy next month (September 1%) out of the money 0.48 delta call options, simultaneously sell near month (August expiry -1%) in the money

This spread strategy is to be employed because we think that the price of the underlying asset will go down moderately in the near term, as we anticipated a short term downswings the premiums collected on In-The-Money calls can pocketed in.

The bear call spread option strategy is also known as the bear call credit spread as a credit is received upon entering the trade.

Hedge Perspectives: Call backspreads

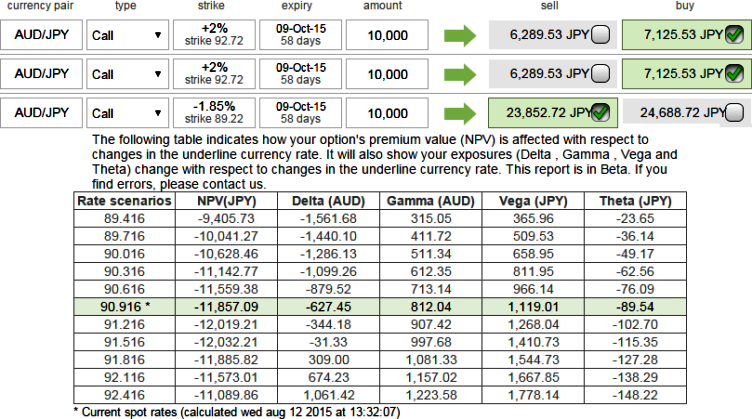

Since moderately bullish trend is anticipated in medium term so we set a target price for the bull run to go beyond 92.70 levels and utilize bull spreads to reduce risk. While maximum profit is capped for these strategies, they usually cost less to employ as you can observe that from the diagram.

Buy 2M (2%) 2 lots of out of the money 0.28 delta calls while shorting 15D (-1.85%) in the money calls (strikes should not go below at 89 levels). We maintain these (ITM & OTM) levels in our strategy by keeping global macroeconomic aspects such as Fed's rate hike measures that may have adverse impact on this pair

Maximum loss for the call back spread is limited and is taken when exchange rate of AUDJPY at expiration is at the strike price of the long calls purchased (i.e. 92.72 levels). At this price, both the long calls expire worthless while the short call expires in the money.

FxWirePro: Falling wedge formation on AUD/JPY – Bear call spreads for speculating and Call backspreads for long term hedging

Wednesday, August 12, 2015 8:16 AM UTC

Editor's Picks

- Market Data

Most Popular

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate