Option Trade Strategy: Buy 3m USDRUB call strike 59, Sell call strike 62 knock-in 65 Indicative offer: 1.23% (vs 1.06% for the vanilla call spread, spot ref: 56.50) The position entails buying a USDRUB 3m call strike 59 financed by a call strike 62, with a topside knock-in at 65 only on this short leg.

This structure offers potential extra gains compared to the vanilla call spread capped at 62, as the pay-off captures upside up to 65. In the event of a move beyond this barrier, the maximum gain is the same as for a vanilla call spread. Our appearing call spread costs only 17bp more than a vanilla proposal, but it potentially hedges twice as much RUB downside (about 10% instead of 5%), providing additional exposure at minimal cost.

Risk profile: Limited to the premium paid Below the 59 call strike, the maximum loss is limited to the premium paid.

Take advantage of high skew Negative carry is quite punitive in forwards (-75bp/month), so cost-effective option exposure is a good alternative.

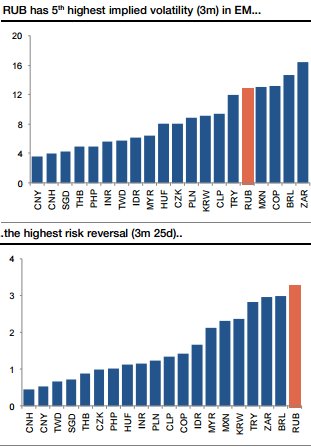

Shorting the RUB in volatility space is also very expensive: implied vol is one of the highest in EM and risk reversals are the highest. The skew-to-ATM volatility ratio has been rising steadily since early 2016, likely related to investors hedging bullish RUB price action. These volatility parameters favour structures that sell topside skew to cheapen up bullish USDRUB exposure.

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge