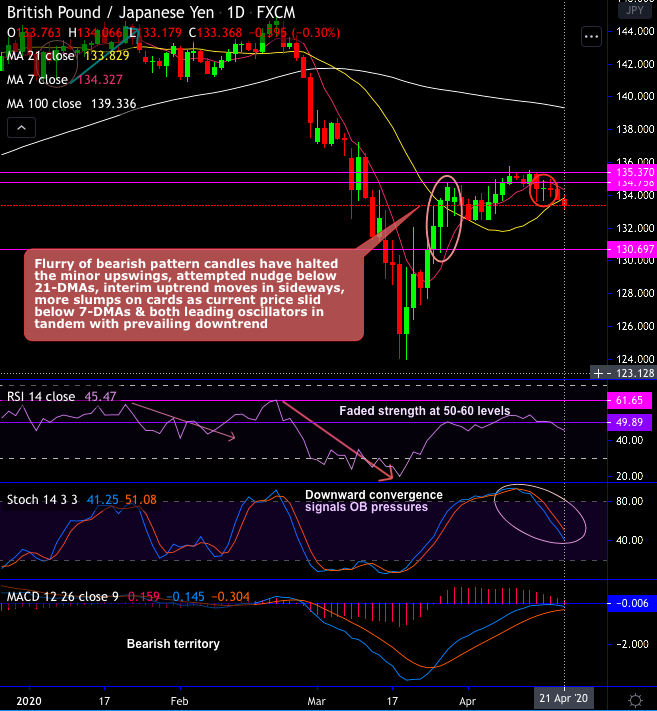

GBPJPY has shown interim rallies in the minor trend amid major downtrend. Currently, the bulls are exhausted at the stiff resistance zone of 134 - 135 levels as per our earlier post, where we had explicitly stated that the resumption of downtrend cannot be totally ruled out.

Streaks of bearish candles, such as hanging man, long-legged doji and spinning top patterns have occurred at this juncture, these bearish patterns have halted the recent minor upswings and attempted nudge below 21-DMAs. Consequently, the current uptrend is drifting in sideways. For now, more slumps seem likely as the current price slid below 7-DMAs and both leading oscillators (RSI & Stochastic curves) are in tandem with the prevailing downtrend.

Major Trend Analysis: The major downtrend still remains intact as the consolidation phase has just retraced 23.6% Fibonacci levels & capped below 21&100-EMAs, the downswings are likely to prolong further as both leading oscillators indicate the selling momentum again.

MACD halts below zero mark which is an equilibrium or bearish territory also substantiates the above bearish stances on a broader perspective.

Overall, we wish to reiterate that as the interim rallies seem to have been exhausted, more slumps are on the cards and the major downtrend unlikely to reverse.

Trade tips: At spot reference: 133.297 levels (while articulating), contemplating above technical rationale, one can execute one touch put options using lower strikes at 132.400 levels. Such exotic option will participate in downside movement and fetch leveraged yields as compared to spot.

Alternatively, we advocated shorts in futures contracts of mid-month tenors with a view to arresting potential dips, since further price dips are foreseen we would like to uphold the same strategy by rolling over these contracts for May month deliveries.