The April inflation data release out of Sweden reinforced our bullish medium-term view of the Swedish krona. With the Frexit risk evaporating with Macron's victory in the French presidential election, the market focus is increasingly turning to the potential for monetary policy shifts in Western Europe, particularly towards tightening.

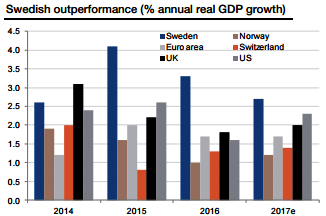

The Swedish economy has been performing well for some time now, but the Riksbank has kept its dovish policy bias, given its lack of confidence about the durability of the reflation trend in the country (refer above chart).

This caution was not unwarranted, as we have seen how stronger growth has not translated into much higher inflation pressures outside Sweden. Moreover, the Riksbank has its own bitter experience from 2011-12, when headline CPI toppled from 3% to under 0% in a span of 15 months.

Growth and inflation data remain at odds in Sweden. Growth has been running at 4% annualized pace for the last two-quarters and the manufacturing PMI is the highest globally at a heady 65.2 (services at 61.3), yet the primary preoccupation of the Riksbank — inflation — has disappointed yet again.

In addition, an outcome for the French elections in line with our base case could result in modest EUR strength. To cushion against these moves we recommend raising the stop-out level on EURSEK by 0.55. Short NZDSEK through a put has underperformed substantially.

With a month left to expiry, we look for opportunities to unwind this trade.

Sold EURSEK at 9.4847 on January 13. Marked at -1.68%.

Long a NZD put/SEK call, strike 6.10, expiry May 23. Paid 1.47%, marked at 0.22%.

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic  BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan