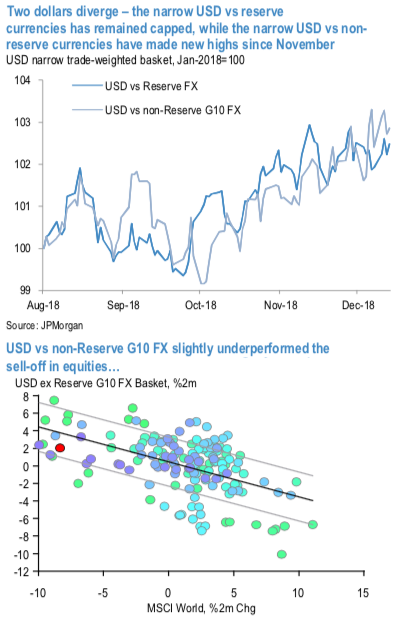

Since late November, as the US cycle risk repricing was unfolding, the dollar went on to make new highs versus its narrow non-reserve FX basket, while narrower US rate spreads helped contain USD strength versus other reserve currency peers (refer 1stchart). From this “two narrow dollars” perspective, the dollar has modestly undershot non-reserve G10 currencies (by 1.7%) given the magnitude of sell-off of global equities (refer 2ndchart). But the USD has remained unusually resilient against other reserve currencies given the narrowing of rate spreads, staying flat rather than declining 1% as a hybrid rate/yield curve spread model might suggest.

EURCHF is a realistic proxy for a tactical short in EURUSD given that the two has been 85% correlated over the past three years. Whereas we suspect this relationship is at risk of breaking down should EURUSD ever rally aggressively, we suspect EURCHF will continue to closely track EURUSD whenever the euro is under pressure. This all comes down to Switzerland’s superlative external position and the possibility that the SNB has reached or is closer to the limits of its ability to intervene to frustrate a fundamentally justified appreciation in CHF.

Simply put, the SNB has recycled virtually all of Switzerland’s current account surplus for a decade (contrast this with the BoJ which has done none), yet the SNB’s ability maintain this policy in a shakier asset market environment is questionable with the balance sheet at 122% of GDP and provisions sufficient to cover only a 17% asset write-down (i.e. the SNB is effectively 5.3x levered). The SNB has notably omitted to intervene since the spring despite the Italian crisis and it can be no surprise therefore that the CHF NEER is 6% higher than the trough in May.

When we published the 2019 Outlook we argued that the big dollar turn was not yet imminent. Nevertheless, the base case for 2019 does envisage a handover from US to Euro area growth and mean-reversion in undervalued European FX. SEK screens as the cheapest European currency (REER 14% below 20Y average) and also has a central bank that is poised to slowly reverse its multi-year experiment with super easy monetary policy. We consequently added a medium-term put spread in USDSEK, but structured it as a 1-1.5x to lower the cost as we lacked conviction that the trade was yet poised to work. We weren’t wrong in that judgement; it obviously remains to be seen whether EUR and SEK can turn things around against the dollar by the middle of 2019. Courtesy: JPM

Trade tips:

Sell EURCHF at 1.1244 with a stop at 1.1469.

Long a 6M 8.55-8.15 USDSEK ratio put spread in 1x1.5 notional. Paid 76bp. Marked at 46bp.

Currency Strength Index: FxWirePro's hourly EUR spot index is inching towards 27 levels (which is mildly bullish), while hourly USD spot index was at 78 (bullish) and CHF is at 0 (absolutely neutral), while articulating (at 10:19 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts