Singapore's industrial production for June fell more than expected by -6.7% yoy. This was dragged down by lumpy items such as the biomedical segment.

However, there were some encouraging signs as the electronics sector rose by over 17%. This is an important swing factor for the economy and could also indicate a potential bottoming in the electronics cycle. This will be positive for the other key electronics exporters in Asia such as South Korea and Taiwan. In terms of implications for Q2 GDP, we could see a slight downgrade from the advance estimate of -12.6%.

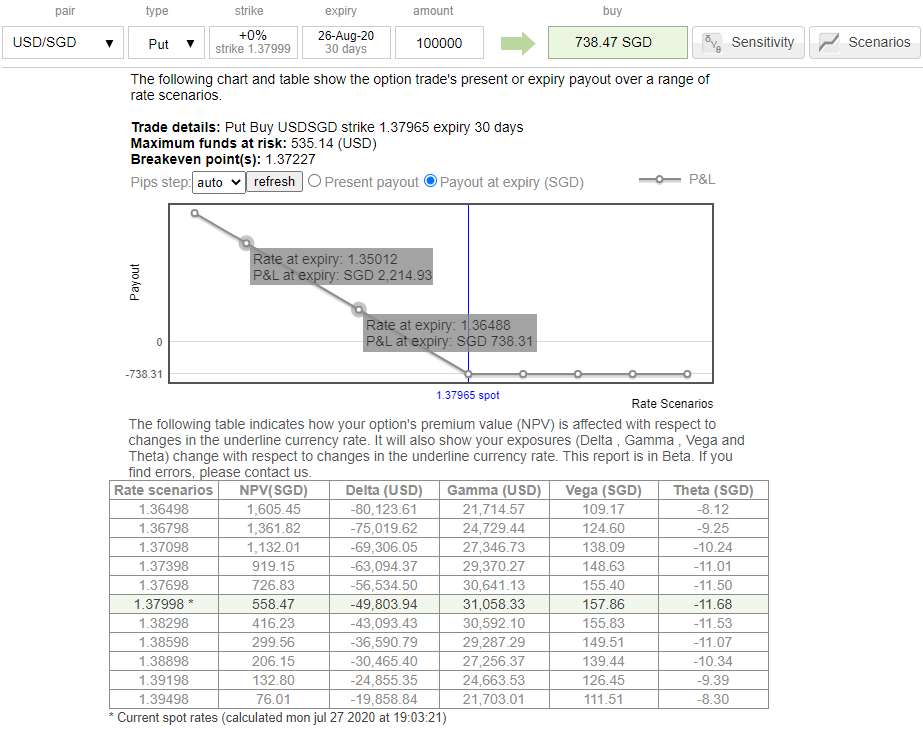

In any case, the economy is still expected to contract by around 8% this year, below the government’s -4% to -7% projection. For USDSGD, it is seemingly in a tug-of-war between USD weakness on the one hand and downside risks for SGD due to the US-China tensions on the other. For today, USD weakness is dominating with USDSGD dipping to the lower end of the 1.38 - 1.40 range of the past two months. Given the uncertainties surrounding CNY, we would be cautious in looking for much lower levels. For USDSGD, we could foresee more downside risks on the cards in the days to come. Hence, we advocate 1m ATM -0.49 delta put options to arrest bearish risks. One could observed the pay-off structure as and when the underlying spot FX keeps dipping. Courtesy: Ore & Commerzbank

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One