Market participants have been on the edge leading into the last policy meeting of the US FOMC, with the VIX spiking to over 25 this week (first time since early February 2018). In the event, the Fed sounded only marginally more cautious, with its members guiding expectations of two further policy rate hikes next year on top of the 25bps hike from today. This may not please the markets, but we find today’s decision and the guidance quite reasonable. Many analysts shade their forecasts to two rather than three FOMC hikes next year, however, emphasis on essentially back to data dependency i.e. if wage inflation accelerates further amid still resilient growth, there is little to stop the FOMC from doing a third hike if the data warrants it. While the FOMC has acknowledged market concerns about a slowing US economy and trimmed its median expectations from three to two hikes next year, the FOMC statement and refreshed economic forecasts.

OTC indications: Above aspects are factored-in OTC markets, while the bearish standpoint is turned on USD vols following their intraweek spike. It is difficult to discern an overarching macro theme from the messy and differentiated price action of the past week.

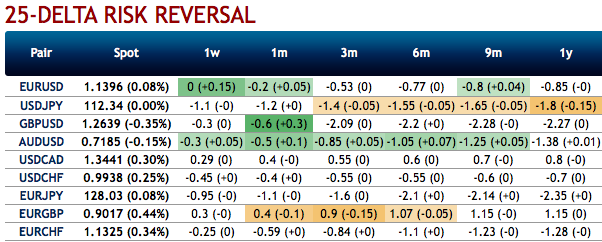

Negative risk reversal numbers of all dollar pairs are also substantiating the downside risks. Note that fresh negative bids are observed for almost all USD crosses, for an instance, please also be noted that IVs of USDJPY that display are tepid among entire G10 FX universe.

While the positively skewed IVs of 2m tenors signify the hedgers’ interests to bid OTM put strikes (refer above nutshells evidencing IV skews).

Trade tips: We feel quite fortunate to be exiting in the black having owned USDJPY through a deep and sometimes volatile correction in US stocks. This wasn’t entirely happenstance - we have argued that structural capital outflows from Japan together with super-wide front-end differentials would dull the yen’s immediate sensitivity to certain falls in risk markets. But we don’t want to stick around too long to find out where the pain threshold for Japanese investors might actually be - we assume that even corporates will slow their accumulation of foreign assets in response to a sufficiently adverse set of macro or market conditions.

USDJPY trade should be squared-off marked at 0.56%, that were bought in September.

Alternatively, on hedging grounds, we advocate shorting USDJPY futures contracts of mid-month tenors as the underlying spot likely to target southwards in the medium-run. Writers in a futures contract are expected to maintain margins in order to open and maintain a short futures position.

Currency Strength Index: FxWirePro's hourly USD spot index was at -52 (which is bearish), while hourly JPY spot index was at 82 (bullish) at 08:04 GMT.

For more details on FxWirePro's Currency Strength Index, visit: http://www.fxwirepro.com/currencyindex

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays