The pair has been pretty much responding as per earlier analysis and we could now foresee a little bit price bounces in near term as the daily chart suggest some buying interest that would result in some price recoveries.

But we maintain our near term targets at 2.0380 levels and towards further southern directions up to 2.0030 mark in medium run, so overall bearish trend has been very robust in long run even though some minor recoveries would be on table.

To substantiate these reversal stances, some sort of bearish patterns and leading oscillators are also converging downwards with current falling price fluctuations; you can figure this out from monthly chart in our earlier post. So we believe that bulls seemed to have been interested in some price bounces in near term.

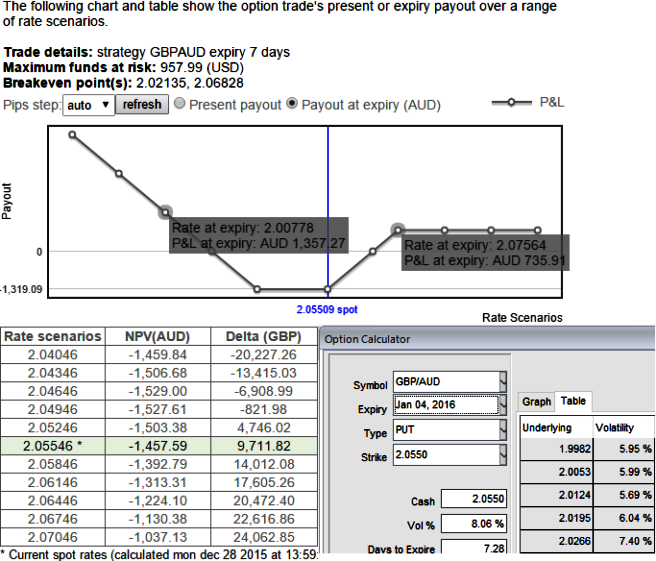

OTC markets seem to be quite poised to factor in these weakness in this pair as we could see reasonable IVs for the contracts of next week expiries. As a result, we recommend capitalizing on the IV factor by employing ITM short puts matching with ATM longs to construct short term back spreads at neutral delta but likely to fetch positive cash flows as shown in the diagram.

Let's shed some light on some guiding principles for evaluating and mitigating risk that traders may want to use to modify their inventive approach:

Be sure that a large move in the underlying pair (targets set at 2.0380 and even 2.0343 levels as well) can be withstood without losing any money. This should be of greater concern than doing the spread for a credit.

Stress-test the spread, assuming that a move will occur any moment.

When trying to assess how a spread may perform, look at the spreads of deeper in-the-money options for an indication of relative option prices. (For a demonstrated purpose we've used 1% ITM instruments and used only 7 days on long side, in real times longer expiries on ATM contracts.

Should a what-if analysis reveal that traders will lose an uncomfortable amount of money, they should either flatten out their ratio, wait for another opportunity in the cycle, or look for a spread in another pair.

FxWirePro: Exploiting GBP/AUD shorts on IVs, balance back spreads with 3:2 ratios

Monday, December 28, 2015 8:51 AM UTC

Editor's Picks

- Market Data

Most Popular

7