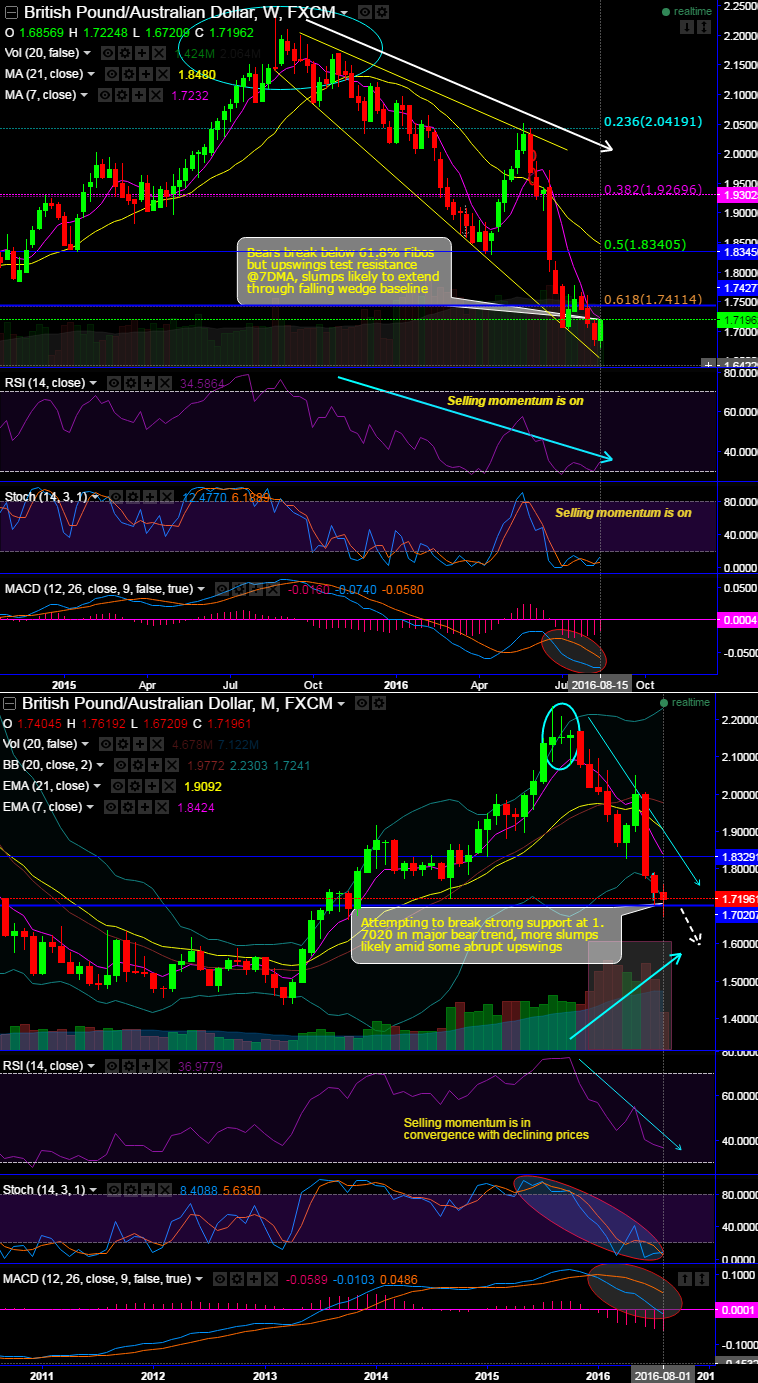

Declining price behavior is going in falling wedge pattern.

Bears have managed to break below 61.8% Fibos, slumps likely to extend through falling wedge baseline (see weekly chart).

It is fine to have some rally after 3 weeks of consistent dips but the rallies have now been testing resistance at 7SMA levels, upswings were unable to sustain above 61.8% Fibos, bears may extend slumps.

As the pair has now slid below EMAs again while 7EMA crosses below 21EMA which is a sell signal, we see bears lining up as and when the price jumps above.

The stochastic oscillator has reached oversold trajectory and there is no sign of bullish crossover, instead, it’s been popping up with selling pressures on monthly plotting.

Although price bounces above, MACD on both weekly and monthly charts have shown bearish crossover and remained below zero levels on weekly plotting, so the major downtrend seems still intact.

Bears can load weights in short as selling momentum is intensified by leading oscillators with mammoth volumes.

Hence, we expect the retest of multi-months lows of 1.6720 in the weeks to come amid any abrupt upswings. So it is advisable to initiate Diagonal Credit Put Spread (DCPS) in order to tackle both short-term upswings and major downtrend. To execute this option strategy one can short 1W (1%) ITM put while buying 1M (0.5%) OTM put option; the strategy could be executed at a net credit.

Alternatively, stay short in mid-month futures contracts for the 1st target of 1.7020 which is next strong support.