• GBP/ AUD rose sharply on Thursday after hawkish comments Bank of England policymaker Michael Saunders boosted sterling.

• Bank of England policymaker Michael Saunders said the central bank could decide to halt its bond-buying programme early due to an unexpectedly sharp rise in inflation.

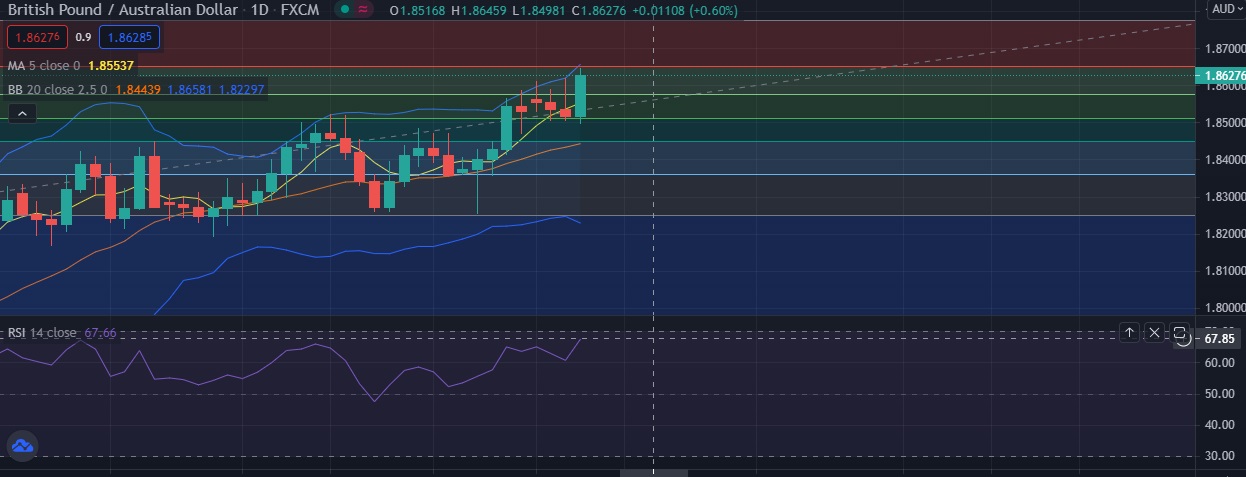

• The pair currently is approaching resistance at 1.8651( 23.6%fib). A break above 11.8651 would unmask 1.8700 level in the short term.

• Technical signals show the pair could gain more ground in the short-term as RSI is at 55,while moving averages and MACD are trending higher.

• Immediate resistance is located at 1.8651( 23.6%fib), any close above will push the pair towards 1.8711 (22nd May 20 High).

• Immediate support is seen at 1.8574 (38.2%fib) and break below could take the pair towards 1.8548 (5DMA).

Recommendation: Good to buy around 1.8600, with stop loss of 1.8520 and target price of 1.8660