The BoC and the BoE appear to be looking to normalize monetary policy but experiencing similar difficulties. Both are involved in uncertain trade discussions that are weighing on investment and both have seen a softer patch of data than the market originally expected. Given it strips out the USD component and has similar risks to the front-end pricing, perhaps GBPCAD is an RV trade worth considering.

Canada’s deteriorating credit growth and soft retail sales have led to short CAD becoming a consensus position and well reflected in the low valuation of CAD, in our view. While Governor Poloz was considered to be dovish by the market, he was still discussing in his recent speech the need for higher interest rates. It would likely take a severe shock to the GDP numbers tomorrow to offset that. Meanwhile, oil supply concerns after the OPEC meeting are leading to an improvement of CAD’s terms of trade that we expect will continue and should see CAD become more supported.

GBP, on the other hand, faces another political test next week with the Cabinet’s Chequers away day designed to decide on the long-term Brexit policy. The Cabinet is still very divided and the talks are likely to lead to further political tensions, potential resignations and leadership concerns that should weigh on GBP.

One big surprise of the trade war rhetoric has been the risk off we’ve seen in markets being driven more by the rise in oil and USD strength rather than trade actions. That is then followed by the disconnection between the underperformance of commodity currencies (e.g., CAD) and the improvement in their terms of trade owing to higher oil.

In our opinion, CAD rates pricing was one reason for the underperformance; there was simply too much priced in the belly of the curve in a fashion similar that was too close to US rates pricing. Then there is the impact of the US tax reform that has led to increased M&A outflows.

Option Strategic Framework:

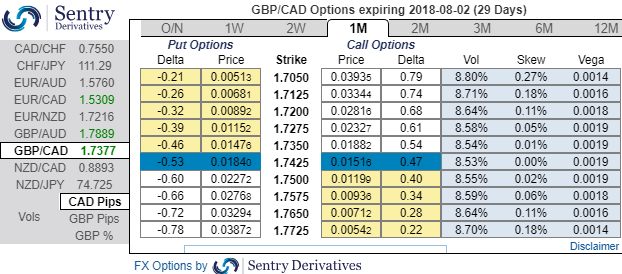

Please be noted that the positively skewed IVs of 1m tenors of this pair is well balanced on either side, technical trend (both minor & major) and above stated fundamental driving forces of this pair have been indicating perplexities which means hedgers’ sentiments of this pair may head towards any directions with more potential on downside in near term.

Accordingly, we advocate below options strategy that is likely to optimize hedging motive.

Strategy: 3-Way Options straddle versus OTM call

Spread ratio: (Long 1: Long 1: Short 1)

How to execute: At spot reference: 1.7374, initiate long in 1M GBPCAD at the money +0.51 delta call, add one more lot of 1M at the money -0.49 delta put and simultaneously, short 1w (1%) out of the money call with positive theta. The short leg with narrowed expiry (lower side) likely to reduce total hedging cost. Courtesy: Nomura

Currency Strength Index: FxWirePro's hourly GBP spot index is at shy above 127 levels (which is bullish) on prints of encouraging UK service PMIs (actual 55.1 versus consensus and previous 54 levels), while hourly CAD spot index is edging higher at 63 levels (bullish) while articulating (at 12:13 GMT). For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?