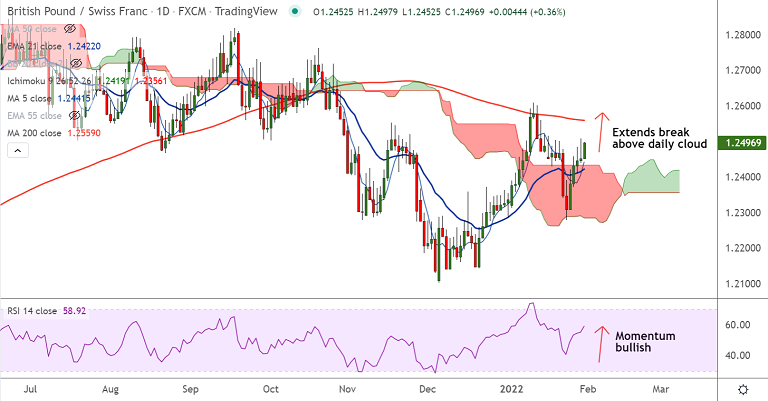

Chart - Courtesy Trading View

Technical Analysis: Bias Bearish

- GBP/CHF was trading 0.35% higher on the day at 1.2495 at around 06:10 GMT

- The pair is extending break above daily cloud, chikou span is biased higher

- MACD is on verge of bullish crossover on signal line

- Momentum studies are bullish, Stochs and RSI are sharply higher

- GMMA indicator shows near-term bias has turned bullish on the daily charts

- Volatility is high and rising as evidenced by wide spread Bollinger bands

Support levels - 1.2441 (5-DMA), 1.2421 (21-EMA), 1.2405 (55-EMA)

Resistance levels - 1.2529 (200-week MA), 1.2559 (200-DMA), 1.2578 (Upper BB)

Summary: GBP/CHF is trading with a bullish bias. The pair is on track to test 200-week MA at 1.2529. Decisive break above will propel the pair higher.