We had expressed surprise that GBP had not rallied even though the subjective probability of a disruptive no-deal Brexit had receded materially over the prior month. This anomaly was corrected with a vengeance in January as GBP rallied by a chunky of 4.5%. But having first undershot in response to favourable developments around the risk of no-deal, it appeared to us that GBP was in danger of over-reacting and was moving from merely removing the negative tail-risk of no-deal, which we estimate to be worth about 3% to GBP’s probability-weighted value, to beginning to price a materially higher probability of no-Brexit. This was premature, in our view, and the subsequent 1.5% correction lower in GBP tends to support such an assessment.

Our forecasts have been moderately constructive on GBP for a while based on our central scenario that PM May will secure a negotiated, orderly Brexit.

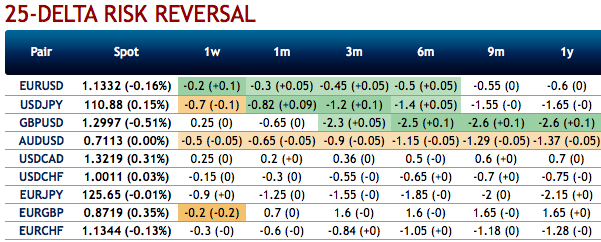

OTC FX Options: We see a minor shift in risk reversals of longer tenors but major bearish hedging sentiments remain intact in near terms, positive bids are observed in the GBPUSD risk reversals of 3m – 1y tenors. While positively skewed implied volatilities of 3m tenors also show hedging interests in bids for OTM puts that signal bearish risks.

Take a look on attractive GBP calls: As you could see 1m GBPUSD ATM calls seem to be priced fairly at USD 1,888.83 which is trading just 6.6% more than NPV, whereas, IVs of these tenors are trending at 10.85%. Hence, contemplating the above fundamental factors, we think these ATM instruments are fairly priced-in. Courtesy: Sentrix & Saxo

Currency Strength Index: FxWirePro's hourly GBP spot index is inching towards 61 levels (which is bullish), and hourly USD spot index has bearish index is creeping at -134 (bearish) while articulating (at 10:17 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation