The somewhat panicky unwinding of Euro (and other European FX) longs might leave macro investors less willing to spend option premium to play for EUR resurgence. In this situation, if one had to pick one Eurobloc currency to buy vol in, our preferred pick would be GBP, especially on the crosses.

While we continue to reckon that the abrupt shift in BoE policy and the attendant possibility of a policy mistake make sterling a fundamentally more uncertain currency than many others. The range of spot outcomes on cable has now opened up from a previously narrow 1.28-1.30 band to a much wider 1.28 -1.36 (or higher) which ought to command a higher premium in implied vols than before.

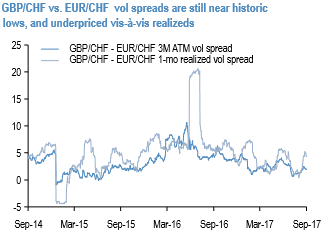

Yet GBP implied vols have retraced 3/4ths of the ramp up from earlier this month and recent realized vols are clocking 1 vol above short dated implieds, hence this appears to be a case of underpriced fundamental uncertainty with supportive technical for gamma ownership. GBPCHF (GBP vs. CHF implied correlation 40%, realized corrs 35%) in particular strikes as a useful long within the GBP-cross complex, we prefer financing it via shorts in EURCHF.

GBPCHF, CHFJPY, and AUDCHF, CHFJPY dual digitals as low premium risk hedges: An eye-catching artifact of the ramp-up in CHF vols is that CHF-denominated (i.e. CHF/X vs. CHF/Y) correlations are now the most overpriced in G10.

Since most CHF-crosses are pro-cyclical in nature, decoupling plays require an anti-cyclical counterpart; USDCHF (typically higher in equity market stress) and CHFJPY (lower) are the only two candidates that fit the bill.

Of these, the utility of USDCHF as an anti-risk play is questionable at a time when European cyclical strength is powering EURUSD higher, which leaves CHFJPY as the only available option.

The GBPCHF – EURCHF vol spread has picked up from 15-yr lows but is still stuck near the bottom-end of a long-term range, the vol spread has a desirable tendency for one-sided eruptions in favor of a wider GBPCHF premium during market crashes, and enjoys a healthy positive carry at inception (2M ATM vol spread 1.9 mid, realized vol spread 4.0 on 1-wk and 4-wk lookbacks using hourly spot data; refer above chart).

Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics