Data schedules:

In the UK: House of Lords on Brexit bill. Article 50 invoked (mid-end-March). SNP conference Mar17-18. Brexit talks. CPI (Mar 21), retail sales (Mar 23), foreign Gilt flows (Mar 29), PMI (manufacturing Apr 3, services Apr 5).

In Japan: G-20 (Mar 17-18), BoJ monetary policy minutes and trade balance (on Mar 21)

Bearish Scenarios: 1) Growth slows below 1% as inflation checks a spend-thrift consumer and business investment fades pre-Brexit, 2) Outright capital repatriation from slower moving long-term investors including central banks, 3) Initial Brexit talks flounder on the size of the UK's exit-bill.

Bullish Scenarios: 1) The government indicates a preference for a lengthy transitional deal with the EU which maintains the trade status quo for 2-3 years (i.e. time-limited EEA membership). 2) The economy rebounds to 2.0-2.5%. 3) The BoE adopts a hawkish bias at the May QIR.

Hedging Recommendation:

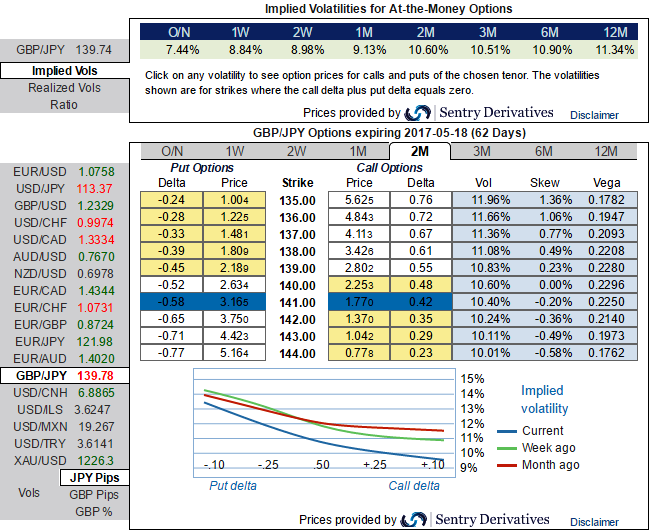

GBPJPY weakness and/or abrupt upswings suggest building a directional and volatility patterns at the same time: the value of OTM puts would likely to rise significantly as the IVs seem to be favoring these distant strikes. We, therefore, recommend buying a 1m2m IV skews and risk reversal with ATM options.

In order to keep above specified risky event on check and to match above IV skewness for 1m2m tenors, we advocate initiating longs in 2 lots of 2m ATM -0.49 delta puts, while long in 1 lot of +0.51 delta call of 2w tenor, please be noted that the payoff function of the strategy likely to derive positive cashflows regardless of swings but more potential from 2 puts are more than 1 call.

The risk is limited to the extent of the price paid to buy the options.

The reward is unlimited till the expiry of the option.

Please note that the trader can still make money even if his anticipation goes wrong – but the spot FX has to move in the opposite direction really fast. The 1 call bought has to beat the cost of buying all the options and still bring in some profits.

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?