GBPJPY has shown a stern downtrend when it attempted for consolidation phase. It’s been dipping again from the recent peaks of 149.716 levels on bearish engulfing candle. We’ve explicitly highlighted further bearish potential of this pair in the days to come in our technical section, please follow below weblink for more reading on the same:

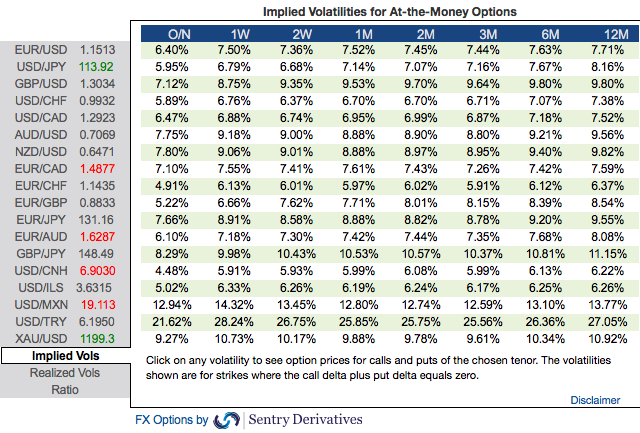

OTC outlook and Hedging Strategy:Please be noted that IVs of this pair that display the highest number among entire G10 FX universe.

While the positively skewed IVs of 2m tenors signify the hedgers’ interests to bid OTM put strikes upto 144 levels (refer above nutshells evidencing IV skews).

Accordingly, put ratio back spreads (PRBS)are advocated on hedging grounds. Both the speculators and hedgers who are interested in bearish risks are advised to capitalize on any abrupt momentary price rallies and bidding theta shorts in short run, on the flip side, 2m skews to optimally utilize delta longs.

The execution:Since the underlying spot has showed minor gains in recent past to the current 148.667 levels while articulating. Short 2m (1%) OTM put option (position seems good even if the underlying spot goes either sideways or spikes mildly), simultaneously, go long in 2 lots of delta long in 2m ATM -0.49 delta put options.

Why PRBS:

Well, the traders tend to perceive these trades as a bear strategy, because it deploys more puts. But actually, it is a volatility strategy.

Hence, entering the position when implied volatility is high and anticipating for the inevitable adjustment is a wise thing, regardless of the direction of price movement. Based on volatility and time decay, the strategy is a “price neutral” approach to options, and one that makes a lot of sense.

The position is a spread with limited loss potential, but varying profit potential. The degree of profit relies on the strength and rapidity of price movement. The position uses long and short puts in a ratio, such as 2:1 or 3:2, to maximize returns. In most long/short spreads, you make money if the stock moves, but you lose if it remains in the middle “loss zone.” A ratio put back spread is different because it creates a net credit, so even if the underlying spot FX price does not move very much, you keep the credit if all of the puts expire worthless.

Every underlying move towards the ITM territory increases the Vega, Gamma and Delta which boosts premium. As you could observe spot GBPJPY keeps dipping, these delta longs would become in the money, while these derivatives instruments target further bearishness of this pair.

Currency Strength Index:FxWirePro's hourly GBP spot index is flashing 172 (which is bullish), while hourly JPY spot index was at 63 (bullish) while articulating (at 07:14 GMT). For more details on the index, please refer below weblink:

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise