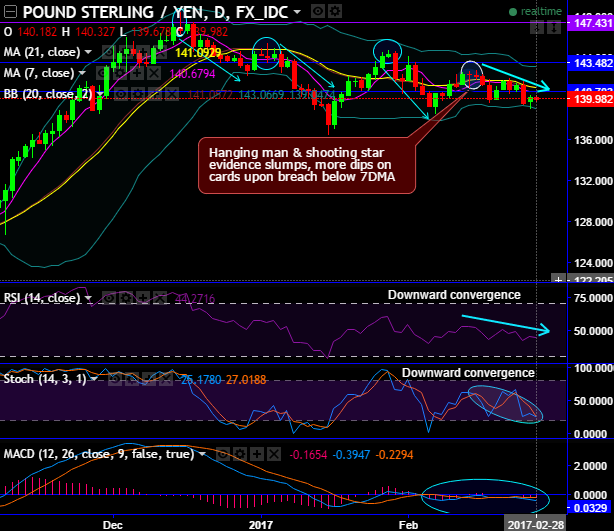

On daily plotting, shooting star pattern occurred at 145.211 levels, and the history repeats in GBPJPY at this level with the bearish formation, as a result, the pair has been consistently dipping that has now gone below 7DMAs.

Same is the case on monthly plotting as well, shooting star occurred at peaks of interim upswings (at 144.328 levels), ever since then the pair has been consistently dipping that has now gone below 7EMA, resuming major downtrend back again.

From last two and half months, the pair has been dipping southwards ever since the shooting star pattern has been formed at resistances where we could the pair has rendered demand and supply sentiments at this juncture several times in the past (monthly charts).

Selling momentum on monthly terms is intensified as we can make out from the leading oscillators (RSI showing strength in bearish sentiments, while stochastic curves have been indecisive but bears' favor) but clearly converging to the prevailing price slumps on daily plotting.

MACD on both daily and monthly terms have been little indecisive but signals the extension of its downswings.

It has now been heading towards next supports at 137.339 and in this robust major downtrend slumps up to the next strong support at 133.878 levels is possible.

Thus, one can speculate intraday bullish rallies but certainly not yet an investment opportunity in GBP.

Well, as a result of above technical reasoning, on speculative grounds we advise tunnel spreads which are binary versions of the debit put spreads.

This strategy is likely to fetch leveraged yields than spot FX and certain yields keeping upper strikes at 140.6804 (7DMA) and lower strikes at 139.0440 (lower BB) levels.

On hedging grounds, initiate shorts in futures contracts of mid-month tenors to arrest the potential slumps up to 133.878, keep a strict stop loss of 143.482 levels.