- The pound sterling is extending weakness, remains on the back foot ahead of UK employment data due later today.

- Pound largely ignores UK data released yesterday which showed inflation rose to 6-year high in November. Technical studies favors downside in the pair.

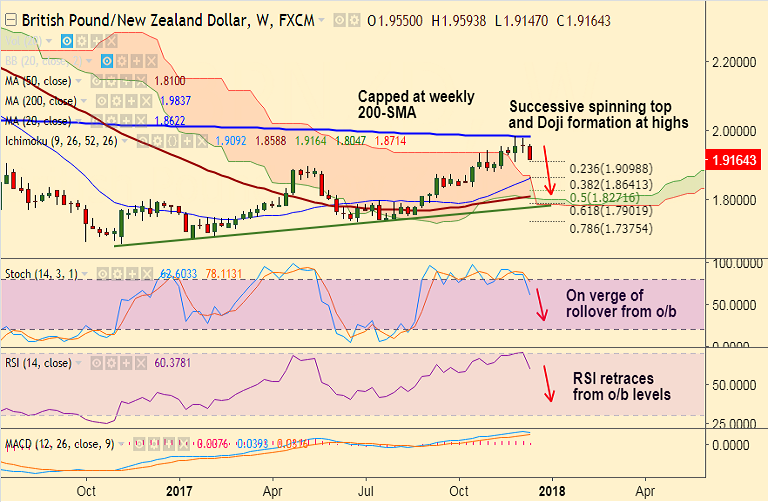

- GBP/NZD has failed at 200W SMA, bears eye 50-DMA at 1.9092 which is immediate support.

- We see successive spinning top and Doji formation at highs which reinforce weakness in the pair.

- An upbeat jobs data and wage growth numbers could help the Pound gain some strength.

- Focus also remains on PM May's parliamentary showdown with Brexit rebels which could impact the pair.

Support levels - 1.9098 (23.6% Fib retrace of 1.67049 to 1.98383 rally), 1.9092 (50-DMA), 1.8561 (100-DMA)

Resistance levels - 1.9399 (5-DMA), 1.9416 (5W SMA), 1.9427 (20-DMA)

Recommendation: Good to go short on break below 50-DMA at 1.9092, SL: 1.94, TP: 1.8785/ 1.8641/ 1.8350.

FxWirePro Currency Strength Index: FxWirePro's Hourly GBP Spot Index was at -67.338 (Neutral), while Hourly NZD Spot Index was at 131.56 (Bullish) at 0900 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest