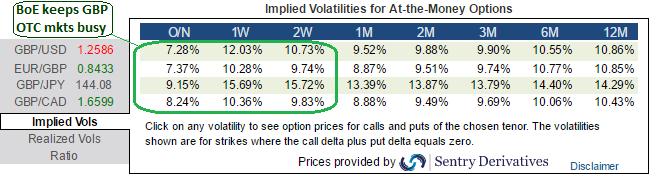

The ATM volatility of GBP crosses to spike crazily until next week’s BoE monetary policy meeting, We are expecting calm down a little after another roller-coaster ride in the GBP around the BoE meeting on next Thursday.

The British economy advanced 0.5 pct on quarter in the three months to September of 2016, slowing from a 0.7 pct expansion in the previous period and in line with the preliminary estimate.

Today, the only UK data to grab the attention is that the trade balance and whether economic growth is continuing to hold up in Q4. A much weaker than expected October industrial production earlier in the week points to downside risks for Q4 GDP growth.

However, the PMI has provided a first taster. The construction PMI in the UK increased to 52.80 in November from 52.60 in October of 2016. Construction PMIs in the UK averaged 51.85 from 2008 until 2016, reaching an all-time high of 64.60 in January of 2014 and a record low of 27.80 in February of 2009.

While Services PMI in this region increased to 55.20 index points in November from 54.50 index points in October of 2016.

The cable volatility surface has returned to levels seen at the start of the year overall, but risk reversals and butterflies are now excessively cheap: - The sell-off in the cable skew is exaggerated compared to ATM volatility, since the risk remains asymmetric on the downside; - The tail risk is mispriced, as the GBPUSD butterfly is now less expensive than the EURUSD butterfly, which is unsustainable given the GBP extra tail risk.

Volatility investors in GBP should consider buying OTM puts and/or being long of the smile convexity, against ATM volatility. But further cable weakness to come suggests building a directional and volatility position at the same time: the value of OTM puts will rise if the pair breaks below 1.25. We, therefore, recommend buying a 3m risk reversal.

Furthermore, sterling’s export-supportive declines notwithstanding, an export-led boost and rebalancing away from services and the consumer still seems relatively distant on these data. Indeed, following yesterday’s ONS restatement of UK external trade statistics back to January 2015, the net trade contribution in 2016 Q3 – initially estimated to be positive in the second estimate of GDP – now looks likely to show a drag.

On the data front, the trade gap in the UK contracted to GBP 9.71 billion in October from September 2016 which is adding extra impetus in GBP volatilities.

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate