After festive season, EURUSD surprises on geopolitical turmoil. Last week the euro temporarily even rose to 1.1240. Speculative investors who had been holding EUR-shorts since the autumn of 2018 and were completely spot on with these positions until October 2019 (1.09 levels) are likely to have covered their positions at year-end. Moreover liquidity was very thin over the past two weeks so that the few trades that happened had more of an effect on exchange rates. In the meantime the dollar has already made quite some ground again, though.

Will everything be back to normal as of today? This is unlikely, as the majority of traders and investors will only return to their desks today and will have to settle in again so that liquidity will only start rising slowly over the course of the week. On the economic front there is some positive news though. The latest PMIs almost all point to a stabilisation of the situation, both in the euro zone and in China - the US ISM index disappointed clearly though, illustrating that particularly the industrial sector with an international bias is still struggling, but domestic sub-components are keeping up well. The stabilisation of the indices is no doubt also due to the fact that the phase 1 agreement between the US and China is going to be signed on 15th January and that the falling uncertainty surrounding the trade conflict is being positively reflected in the indices. That gives rise to the hope that the global economy is not going to slow any further, so that even the last recession concerns on the markets are going to be overcome. The Fed nonetheless keeps the door wide open for further rate cuts which was reflected in the Fed minutes on Friday.

However, now things are boiling up on another front again. The escalation of the conflict between the US and Iran is leading to a rise in risk aversion on the financial markets. I fear that this year is not going to provide much momentum on the monetary policy front either, whereas President Donald Trump will cause significant unrest on the markets. Be it because of the negotiations between China and the US becoming more difficult again following the signing of the phase 1 deal or be it in the form of other (geopolitical) conflicts. Trump will have to defend his position during the election year and will have to sell himself to his electorate. Unfortunately that points towards uncertain times and increased uncertainty on the financial markets, which might fuel a flight into safe havens every so often. So as a result the dollar might appreciate every so often.

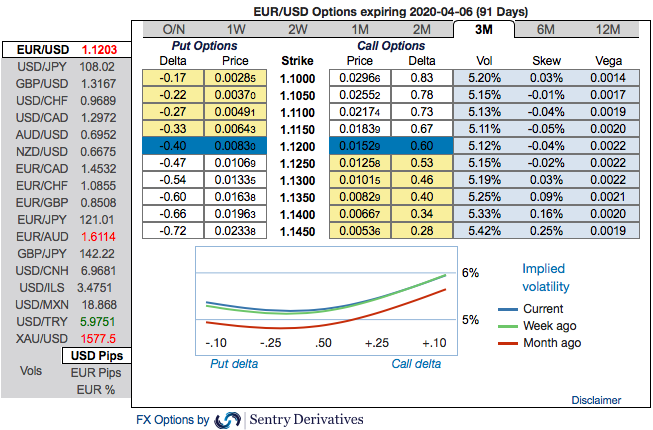

The overall risk bias is positive reflecting EUR’s strong structural fundamentals and US political risks. 3m skews indicate both bullish and bearish risks but with more skewness for bearish risks.

Hedging Strategies: Contemplating above factors, initiated long in 2 lots of EURUSD at the money -0.49 delta put options of 3M tenors, write an (1%) out of the money put option of 2w tenors, (spot reference: 1.1197). Short-legs go worthless as the underlying spot price hasn’t gone anywhere. Any slumps from here onwards are to be arrested by the 2 lots of ATM long-legs.

Those who want to participate in the prevailing rallies in the short run, one can freshly initiate the strategy. The directional implementation of the same trading theme by further allow for a correlation-induced discount in the options trading also if you choose strikes appropriately.

Stay long trade in EURUSD digital call:

Prices for levered versions of call spreads have recently been the lowest in five years due to record low base vols and positive risk reversals. So while the timing for European reflation trades is not ideal absent better data, this is partly offset by attractive cost considerations. The strong Conservative majority provides some support to EUR as well, and we keep an eye on momentum above 1.12. Broad-dollar selling into 1Q should further support the trade.

Add longs in a 3M 1.15 digital EUR call/USD put for 11.5% (spot ref 1.1012). Marked at 16.7%. Courtesy: JPM & Commerzbank

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure