The RBA’s forecasts have been updated with the publication of the November Statement on Monetary Policy (SoMP).

The growth outlook is “little changed” and the unemployment rate is expected to fall to 5¼% by Dec 2019. Inflation is expected to be a touch lower than previously estimated, with a pick of 2% for the core measures by the end of 2019.

Despite this, the Bank explicitly states that “the assessment of pricing pressures in the near term has not changed.”

Using the RBA’s forecasts in our estimate of the Bank’s reaction function produced a projection of modest tightening cycle from 2018.

AUD was hurt by the decline in equities, falling from 0.7694 to 0.7650 against USD but partly recovering to 0.7680.

The NZD was the underperformer, despite the small hawkish surprise delivered by the RBNZ earlier, falling from 0.6980 to 0.6934 against USD.

AUDNZD ranged sideways between 1.1020 and 1.1050, preserving a 70 pip fall post-RBNZ.

While volatility remains close to all-time lows and risk sentiment is (again) at the ‘hope’ threshold, some drivers of low volatility are starting to turn.

China’s activity indicators for October are expected to show some moderation, partly due to tightening of environmental protection standards.

Options strategy:

AUDNZD major downtrend has been drifting in the consolidation phase and jerky in short run, drop to 1.0850 levels.

AUDNZD in medium-term perspective: Expect the 1.0809 area to be tested again for the day if iron ore remains under downward pressure. A retest of the 1.10 area seen in April is also possible if iron ore’s rally since mid-June continues and global risk sentiment remains elevated.

We’ve seen the bearish impact on underlying AUDNZD movement in the major trend. Technically, the price behavior has been weaker with both leading as well as lagging indicators are bearish bias.

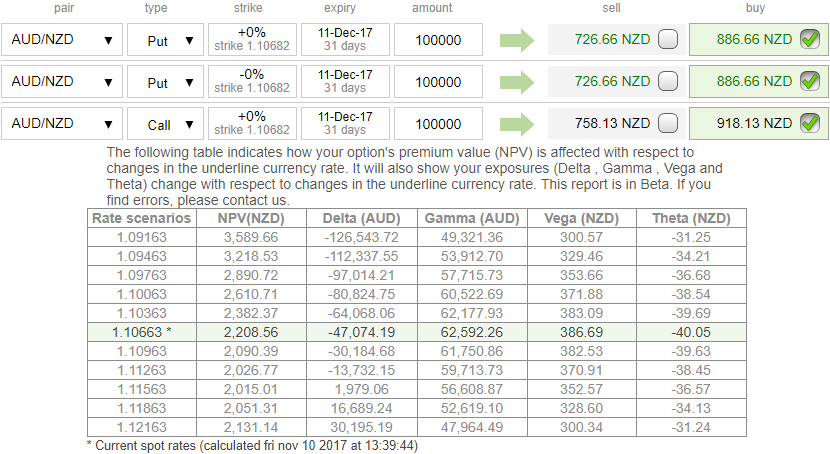

To participate in the puzzling swings, we advocate option strips strategy that contains 3 legs of vega longs (2 puts plus 1 call). Contemplating above fundamental political developments and the ongoing technical trend of this pair. The option strips that likely to fetch desired yields regardless of the trend but more potential on southwards by arresting bearish risks.

The execution goes this way: Initiate 2 lots of 1m longs in Vega put options, simultaneously, add 1 lot of Vega call options of the similar expiry, the strategy is executed at net debit.

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure