The dollar is seeing its fourth successive week of trade-weighted gains, mirroring a four-week gain in Treasury yields amid hopes of a tax-cutting fiscal package and expectations of a December Fed rate hike. We combine our EM macro fair value bond yield model with SG economics and US/European rates forecasts to gauge the possible change in EM 10yr yields out to 3Q 2018.

At the other extreme, the Swedish krona is the biggest G10 faller, after the news that Risksbank Governor Stefan Ingves has been appointed to a third term. He is the architect of the policy to target the SEK’s exchange rate, and therefore keeping rates low despite a robust economy. Between those two extreme, the resilience of the yen and Swiss franc speaks to slight risk-aversion as US yields rose, and so it’s no surprise the commodity-sensitive NZD, AUD and NOK are also weaker.

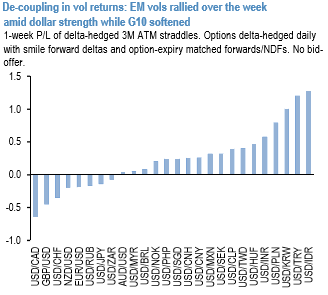

G10 vols fell and EM vols rose during this week’s dollar shakeout, but decoupling is unlikely to sustain. Asian FX (INR, IDR, KRW) vols are most susceptible to mean-reversion lower in EM.

The push and pull of offsetting factors that had nudged us towards a more balanced view on vol were on full display this week.

EM gamma spiked sharply as the shakeout in dollar shorts played out most violently in heavily-positioned in carry trades in EM and lifted delivered vol, but G10 vols fell as the sapping of bearish USD momentum prompted liquidation of USD puts, especially versus European currencies (refer above chart).

Absent idiosyncratic currency impulses (e.g. event premia keeping certain vols elevated), decoupling tends to be a short-lived phenomenon in FX vols, so decent odds that this week’s performance gap will close via a drop-off in EM implieds once the month-end dollar kerfuffle subsides.

Asian FX – IDR, KRW, and INR – witnessed the sharpest vol backups this week and hence are also the most susceptible to mean-reversion. Courtesy: JPM

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed