The global picture on the volatility front hasn’t really changed in recent months. Implied and realized volatility is still hovering in their low or very low percentiles. The currency market has been acting as the adjustment factor between countries positioned at different parts of the economic cycle clock built.

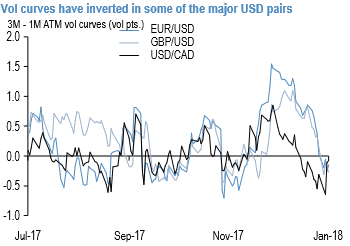

The eye-catching jump in front-end USD vols of late -VXY Global is up 0.7 % pts from the middle of last week --has led to the inversion of vol curves in a handful of major currencies (refer above chart). Coupled with palpable anxiety around the longevity of the unusually swift dollar downtrend, this vol structure is motivating considerations of short front vs. long back USD put calendar spreads as theta harvesting overlays on dollar shorts.

We are not convinced about the advisability of such structures however when realized vols are typically rising alongside a weakening dollar; the persistent forecasting error in recent weeks has been to underestimate the velocity of the dollar downtrend, and there is little evidence that consensus expectations have necessarily adjusted for these misses judging from the general surprise at yet another late-week drop in USDCNH.

The only currencies where one might consider sell/buy USD put calendars with some conviction are those where central banks have voiced concerns about FX strength and/or potentially defended a short-term floor (e.g. 1060 in USDKRW), but even there, powerful macro (trade-related appreciation pressures) and flow (equity inflows) forces could derail option constructs reliant on precise timing of spot moves. Courtesy: JPM

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand