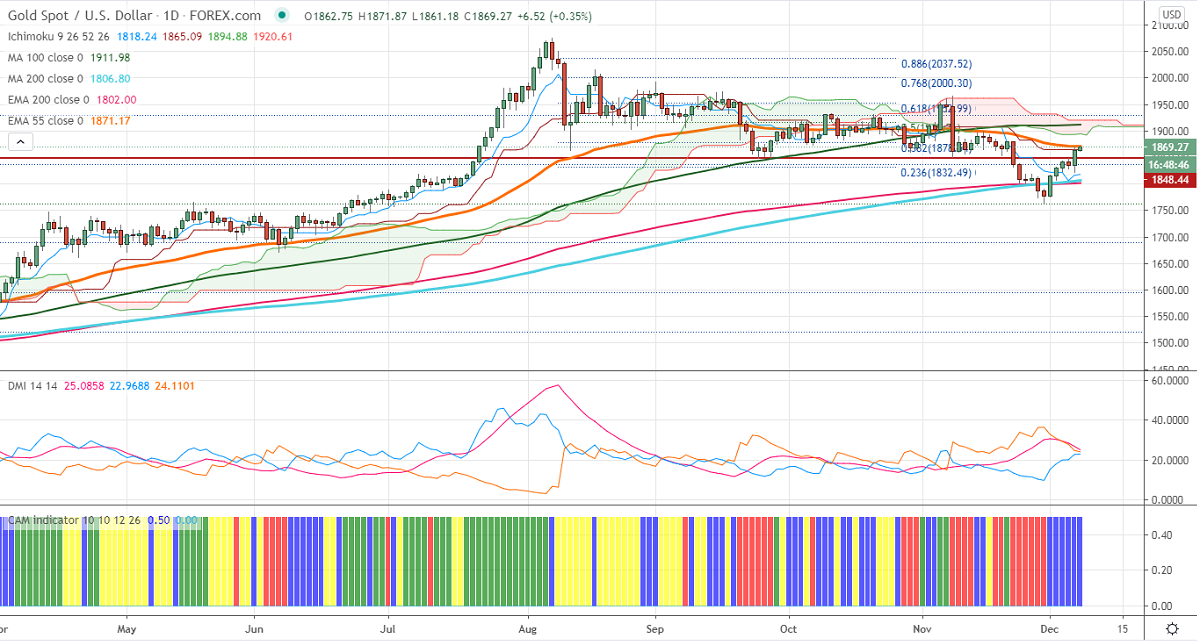

Ichimoku analysis (Daily chart)

Tenken-Sen- $1816

Kijun-Sen- $1865

Gold jumped sharply yesterday more than $40 on surging COVID cases in the U.S. The number of corona cases in the USA surged for 3rd consecutive days and hits a record 230000 in one day. US dollar index recovered slightly more than 50 pips from a low of 90.47. The US 10-year yield jumped more than 20% more than 10% after a decline till 0.825%. The Brexit uncertainty, updates on stimulus from the U.S, Japan are supporting the yellow metal at lower levels.

Economic data:

With no siginificant economic data, this week markets eye Brexit talks which are to happen in Brussels today.

Technical:

In the daily chart, Gold is trading slightly above 21-MA, any violation above $1878 will take the pair till $1900/$1912. On the lower side, near term support is around $1840, any indicative break below that level will take till $1822/$1800.

It is good to buy on dips around $1845 with SL around $1830 for the TP of $1900.