Gold showed a minor sell-off due to profit booking. It hit an all-time high of $2954 and is currently trading around $2881.

New home sales in America got off to a weak start in January 2025, falling by 10.5%. This means fewer new homes sold compared to December.

The average price of a new home was around $446,300. There were many homes for sale, enough to last 9 months at the current rate of sales.

Housing market experts foresee the market increasing gradually this year, by perhaps 3% or less. Mortgage rates are high and financial issues are holding back people from buying new houses

Rate Pause Expectations Diminish

According to the CME Fed Watch tool, the chances of a rate pause on the Mar 19th, 2025 meeting have increased to 97.50% up from 97% a week ago.

Technical Analysis: Key Levels and Trading Strategy

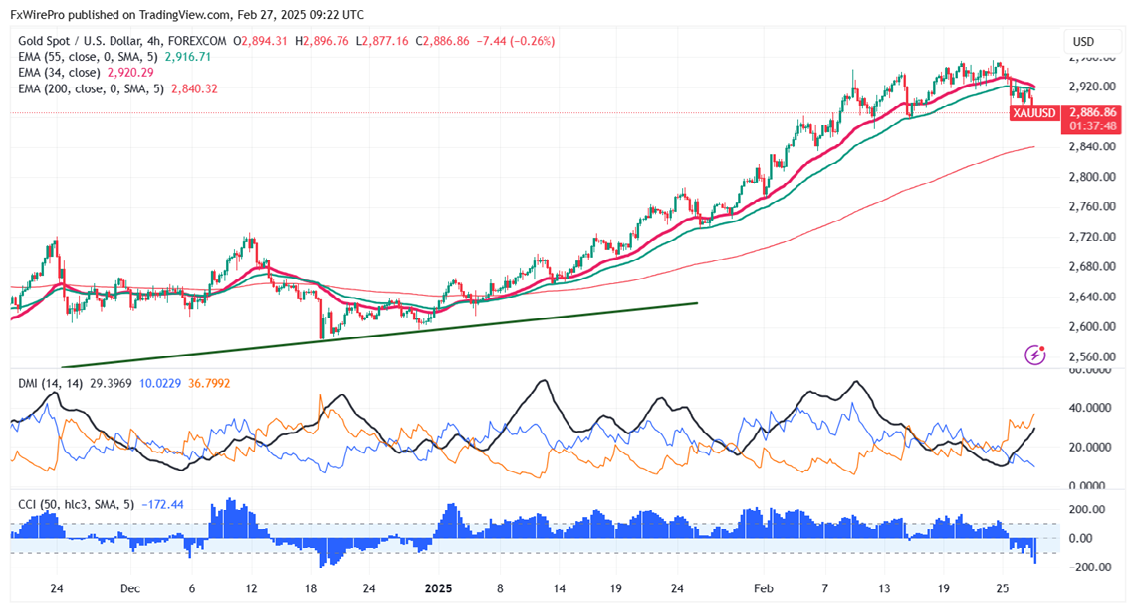

Gold prices are holding above short-term moving averages of 34 EMA and 55 EMA and long-term moving averages (200 EMA) in the 4-hour chart. Immediate support is at $2870 and a break below this level will drag the yellow metal to $2860/$2850/$2830/$2800/$2770/$2740. The near-term resistance is at $2920, with potential price targets at $2940/$2957/$3000.

It is good to buy on dips around $2870 with a stop-loss at $2850 for a target price of $3000.

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings