FxWirePro: Gold Weekly Outlook

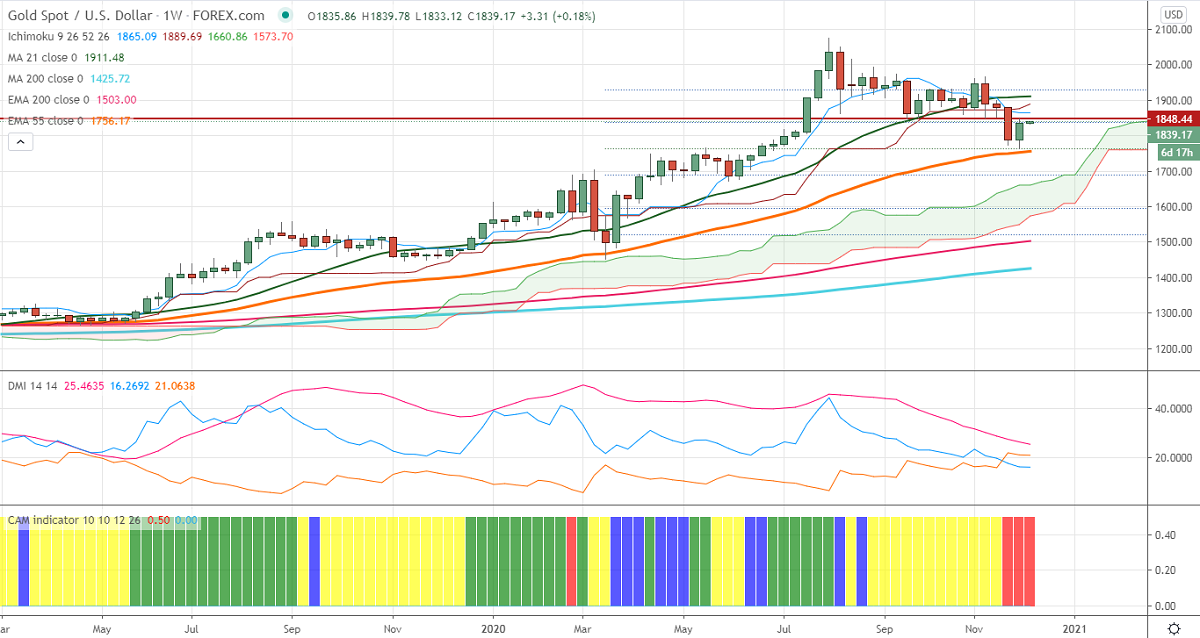

Ichimoku analysis (Weekly chart)

Tenken-Sen- $1865

Kijun-Sen- $1876

Gold has shown a recovery of nearly $100 on a minor pullback in the U.S dollar. The upbeat market mood on the COVID-19 vaccine is putting pressure on yellow metal at higher levels. The chance of stimulus in the U.S due to economic weakness might cap further downside below $1750. DXY hits the lowest level since April 2018; a dip till 90 is possible. The number of people infected due to coronavirus cases in the United States crossed 15 million. The US 10-year yield jumped more than 20% more than 10% after a decline till 0.825%.

Economic data:

The U.S economy has added 245K jobs in November compared to a forecast of 460K. The unemployment rate dipped to 6.7% from 6.8%. US ISM manufacturing index came at 57.5 in November, less than the estimate of 58. While the ISM services index came at six month low in November at 55.9 vs estimate of 55.90

Technical:

In the Weekly chart, Gold has taken support near 55- EMA, any violation below $1825 will take the pair till $1800/$1765. On the higher side, near term resistance is around $1850, any indicative break above that level will take till $1865/$1870/$1900.

It is good to buy on dips around $1825-26 with SL around $1816 for the TP of $1870/$1900.