Technical Inference:

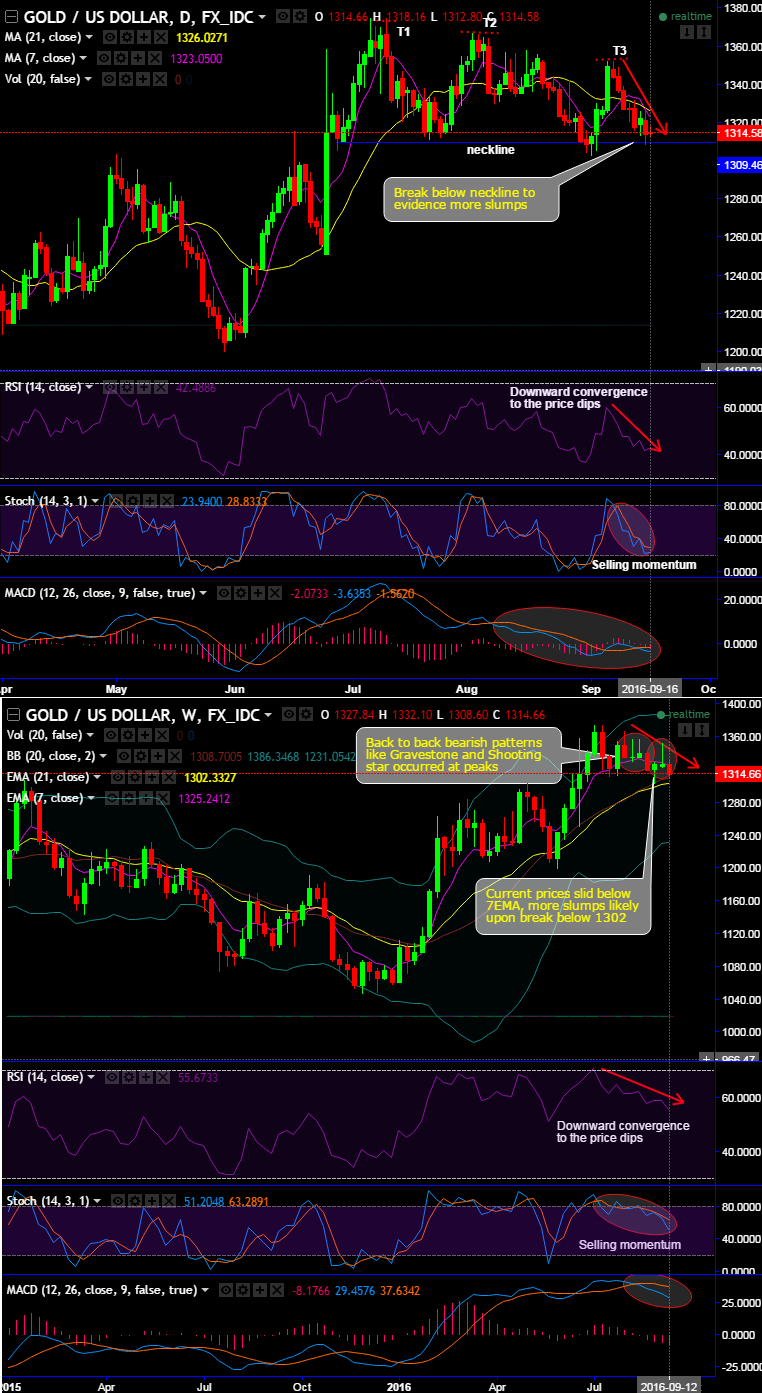

We spotted out the triple top pattern on daily charts of gold prices with top 1 at 1375.15, top 2 at 1367.30, top 3 at 1352.61 and neckline at 1308.42 levels.

The current prices have tested supports at neckline and attempting bounce back, but we foresee any break below the neckline to evidence more slumps.

On daily charts, 7DMA crosses below 21DMA which is a sell signal.

On weekly plotting, back to back bearish patterns like Gravestone and Shooting star occurred at peaks of 1335.49, 1340.90 and 1327.51 levels.

Current prices slid below 7EMA, more slumps likely upon the break below 1308 levels (i.e. the collapse below 21EMA).

Both leading oscillators signal intensified selling momentum. RSI, Stochastic curves have been powerful in suggesting the current bearish trend to prevail as they reached oversold territory but no trace of recovery.

While MACD remains in the bearish trajectory that is likely to drag down further.

Trading tips:

Since the bears in Gold has wiped off buying interest, for now, tumbling consecutively from the last couple of days and on the Comex division of the NYME, gold futures for December delivery were steady at $1,318.50, we recommend staying short in mid-month futures for minimum targets up to 1297 levels with SL 1326 levels.

And alternatively on an intraday basis, at spot reference 1314 levels, those who wish to speculate the prevailing bearish sentiments in bullion markets can consider option tunnel construction for the targets at 1308 levels.

We rely on stochastic and RSI and as they pop up with overbought pressures so far, so smart way to approach this commodity is to deploy the option tunnel using ATM puts is structured as a binary version of a conventional put spread, i.e. long delta puts with higher strikes while writing the lower strikes for above-mentioned targets on either side.