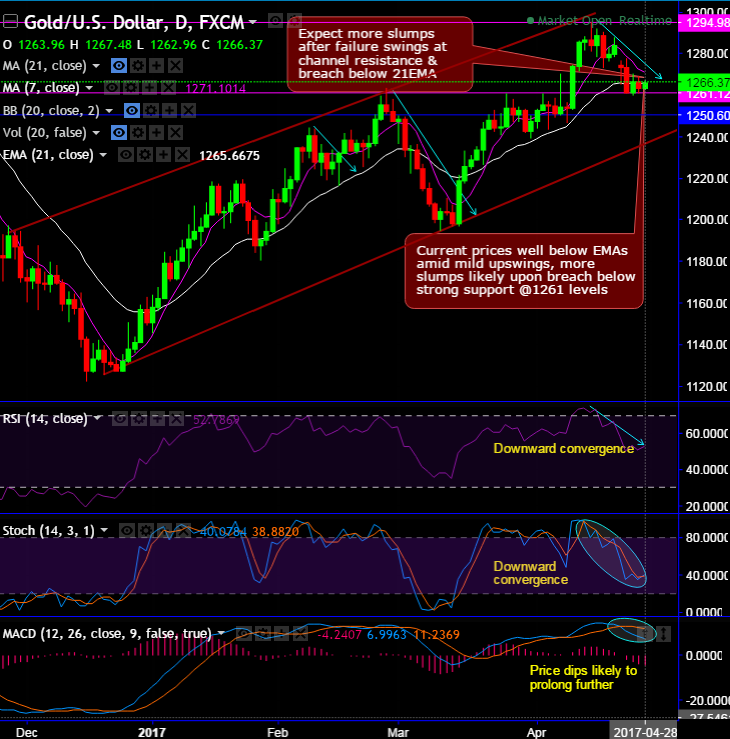

Gold price behavior has been moving in rising channel but failure swings have also been observed as and when it nears channel resistance (refer daily charts).

The current prices are well below EMAs amid mild upswings, for now, more slumps likely upon breach below strong supports at 1261 and 1250 levels.

Historically, shooting star also pops up at this same resistance levels and evidently rest is the history, in an interim uptrend, gold prices have almost retraced to the lows of 1259 from the recent highs of 1295 levels in the consolidation phase.

RSI and stochastic curves are converging to the price drops to indicate the strong selling momentum.

While current prices on this timeframe have been sliding below DMAs, MACD on the other hand signals downswings are expected to extend.

On a broader perspective, bulls in this bullion market have managed to bounce above 50% Fibonacci retracements with a bullish candle with the big real body. Huge volumes are evidenced which is in conformity to this bullish sentiment.

MACD on this timeframe is exactly adverse to the daily terms, this lagging indicator signals the consolidation phase to extend further with minor hurdles.

For an intraday speculation, we for the see price to remain within the range between 1275 and 1260 (i.e. also 7EMA levels on weekly plotting where it serves as a demand zone). Hence, we advocate buying boundary binaries with upper strikes at 1275 and lower strikes at 1260-50 levels.

The trading between these strikes likely to derive certain yields in this puzzling trend and more importantly these yields are exponential from spot movements.

For cash or nothing, these options would be exercised if the forward prices to remain between both strikes (i.e. 1275 > Fwd price > 1260-50).