- Gold continuing its losing streak for fourth consecutive days after hitting year high at $1358 on account of surging U.S dollar and geopolitical tensions eases. The yellow metal jumped almost $40 from the high of $1358.It is currently trading around $1321.62.

- US Dollar gained sharply against all major pairs yesterday after Trump’s tax reform framework will be released in the week of Sep 25th.

- DXY has shown a huge recovery from the low of 91.01 till 92.51. Any break above 92.58 (20 –day MA and trend lien resistance) confirms minor bullishness a jump till 94.15 likely. Major trend reversal can be seen only above 94.15 level. The minor resistance is around 92.29/92.63 (20- day MA).

- U.S 10 year yield rose for third consecutive day after soft U.S 10 –year auctions. It is currently trading around 2.19%.

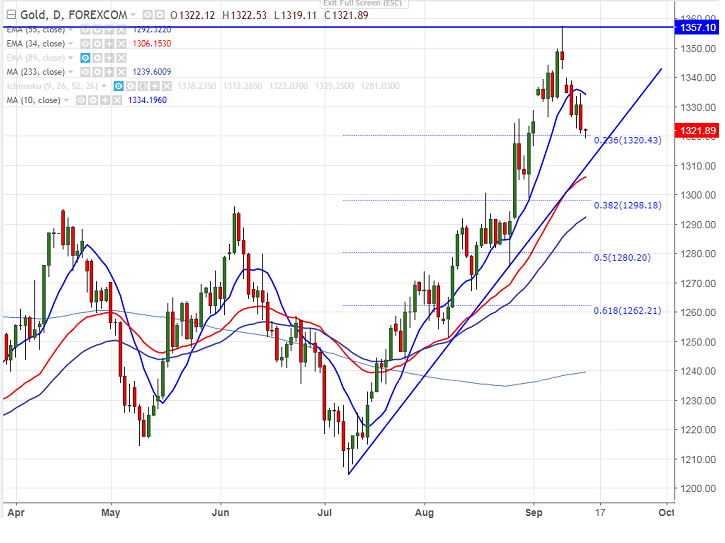

- Technically gold is facing minor resistance around $1335 (10- day MA)and any break above will take the yellow metal to new year high at $1343/$1350/$1358.

- Gold’s near term support is around $1318 (20- day MA) and break below will drag the commodity down till $1312 (daily Kijun-Sen)/$1300.The yellow metal should break below $1250 for minor trend reversal.

It is good to sell gold on rallies around $1326-28 with SL around $1335 for the TP of $1313/$1301.