The German summer nightmare 2018 seems over. The two coalition parties have reached a compromise on the immigration conflict. One major stumbling block remains the possible rejection of the compromise by the Social Democrats (SPD), the coalition partner, but I hope that we will be spared further disagreements.

We’re scaling back the defensive exposures following Europe’s agreement on migrant policy. This should prevent a fracturing of Merkel's coalition and reminds investors that very few issues are genuine existential threats to the EU. That being said, we stay short high-beta FX given that trade conflict will likely remain a chronic drag on confidence.

Europe’s migrant deal is potentially significant for EUR as this issue has detracted from what has been a steady normalization in the European data flow. With political risk now subsiding, there's scope for EUR to modestly rebound in line with neutral data surprises.

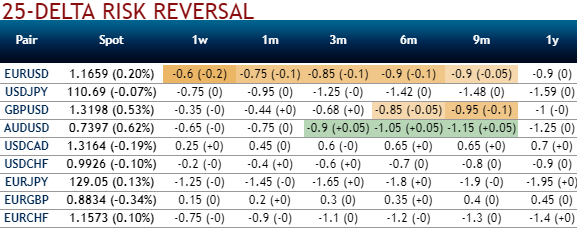

OTC outlook: The positively skewed IVs of EURUSD of 1m tenors signify the hedging interest of bearish risks, while mounting bearish risk sentiment is substantiated by increased negative risk reversal numbers.

Contemplating above-stated driving forces and OTC indications as shown above, accordingly options strips strategy is already advocated about a fortnight ago on hedging grounds. The options strips strategy which contains 3 legs needs to be maintained with a view to arresting price downside risks.

Option Strategy: Options Strips

Combination ratio: (2:1)

Rationale: Considering the bearish technical environment in the recent past and most importantly, the skews in the sensitivity tool indicate hedging sentiments for the bearish risks, these risks are coupled with bearish risk reversal numbers.

The execution:

As shown in the diagram, initiate long in 2 lots of EURUSD at the money -0.49 delta put options of 1M tenors, go long 1M at the money +0.51 delta call option simultaneously.

The strategy can be executed at net debit with a view to arresting FX risks on either side and likely to derive exponential returns but with more potential on the downside.

Currency Strength Index: FxWirePro's hourly EUR spot index is inching towards 37 levels (which is bullish), while USD is flashing at -156 (which is bearish) while articulating at (07:20 GMT). For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex

FxWirePro launches Absolute Return Managed Program. For more details, visit:

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts