Pound recovers on ‘hawkish’ Bank of England, it is quite easy to cook up story like this. Is it wise enough to give all credits BoE? Well, in FX market, it is not the isolated news that drives the action, we would rather look at in a heterogamous perspective.

No doubt, the pound has experienced an acceleration in its uptrend against the US dollar, but in the recent weeks itself which was prior to the BoE event.

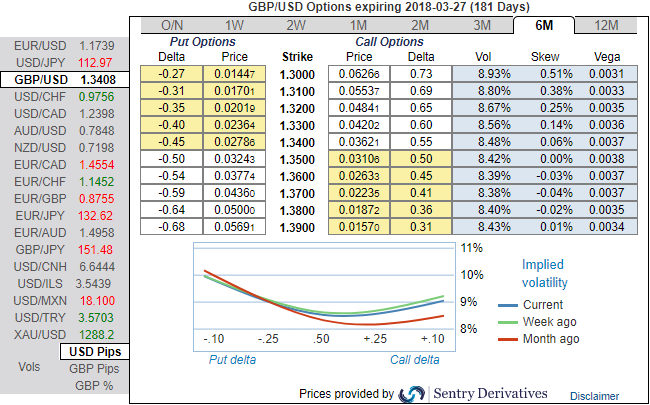

But not disregarding the central bank’s event risk, OTC markets have priced in this news in 1w-1m tenors. Please be noted that the significant shift in risk reversal to positive side as rallies hit the new year-to-date high above 1.3650 at one stage. This was led by a re-pricing of expectations of UK Bank Rate, following ‘hawkish’ minutes from September’s Bank of England (BoE) policy meeting and upbeat comments from Monetary Policy Committee (MPC) members, which caught the market off-guard.

With Brexit negotiations dragging on, we still see downside risks for the pound.

Only once the future relationship between the UK and the EU starts to gain shape do we see room for a sustained recovery of GBP exchange rates.

Even with uncertainty over Brexit negotiations ongoing, the pound gained in September. This was due to the Bank of England (BoE) signaling a rate hike on the back of increasing (core) inflation.

Initially, however, we only see scope for one rate hike, which is unlikely to be sufficient to send the pound higher on a sustainable basis.

Therefore, the downside risks to the pound will predominate for now. Both the ECB and the Fed are likely to tighten monetary policy before year-end, which is why the pound looks set to lose both against the EUR and the USD. This is also evident if you look into the positively skewed implied volatility of GBPUSD of 6-months tenors that is indicating hedgers' interests in downside risks upto 1.30 levels.

Finally, on the flip side, any cyclical/Fed repricing needs to be considered in context of what is happening in the rest of-world where in some places the recent or potential repricing might be more significant. For example, as mentioned earlier, the more significant policy repricing in the past two weeks was in the UK, and the resulting 3% rise in GBPUSD certainly was a drag on the magnitude the USD index was able to rise on its own policy repricing, and explains why the DXY index (where GBP has a 12% weight) failed to advance in the past two weeks in spite of the Fed story.

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady