Technical Glimpse:

Bulls are rejected at the resistance of 1.0090, massive volumes formed on declining prices in non-directional trend.

Although it seems like testing at 0.9735 (7EMAs on monthly charts), bullish momentum is shrunk away on technical indicators. It is now facing a stiff resistance at 1.0090 levels.

Significant Economic Events for the week:

Canadian GDP on Wednesday, consensus 0.5% and previous -0.6%.

Australian monthly building permits on Monday, consensus 1.2% and previous -2.9%.

Australian Capital expenditure on Wednesday, consensus -4% and previous -5.2%.

Australian retail sales on Wednesday, consensus 0.3% and previous 0.1%.

Canadian trade balance on Friday, consensus -3.2B and previous -3.6B.

FX Option Strategy: Short Put Ladder (AUDCAD)

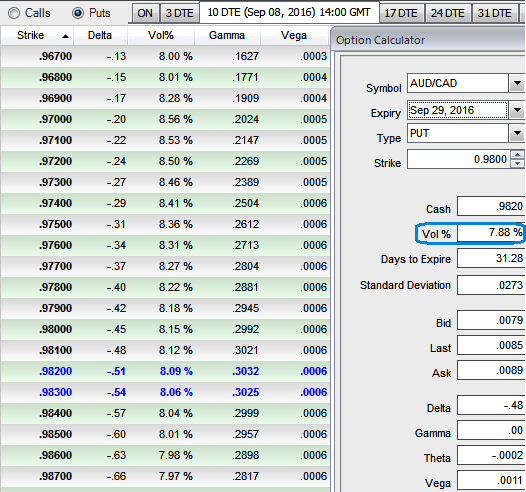

Despite many expectations from above economic events, IVs of ATM contracts are stagnantly creeping up at 7.88% of 1m tenors and at 8 to 8.25% for 1w expiries.

So, on hedging grounds, the rationale to formulate the below option strategy is that using uninterested sentiments in OTC FX of this pair, option writers are on the upper hand owing to the lacklustre IVs in 1w expiries.

Consequently, the recommendation would be buying (1%) ITM -0.49 delta put + Sell (1%) OTM put option + Sell another deep (1.5%) OTM put option, all contracts with similar expiry.

We focus on this lacklustre IV factor that is favourable for writing opportunities OTM options. Low IV implies the market thinks the price will not move much.

Hence, the recommendation is to deploy "long put ladder spreads" that contains proportionately less number of shorts and more longs which would take care of potential slumps on this pair.

We reckon that for next 2 months time CAD would gain reasonably on account of consolidating oil prices and stable monetary policy by Canadian central bank.