Key Economic Fundamentals:

The yen eased further in Asia on Friday ahead of preliminary GDP data that is scheduled on next Monday.

Japan prints October PPI MoM -0.1% versus previous 0.0% and YoY -2.7% versus -3.2% previous.

On the data front, Canada is awaiting for today’s Poloz’s speech and manufacturing sales and core CPI MoM flashes during next week. While Japan eyes on Preliminary GDP QoQ.

OTC outlook & Hedging Framework:

In the major downtrend, CADJPY spot is testing to approach minor resistance at 79.816 levels and may struggle for sustenance and as a result, CFDs of this pair slightly have been drifting down.

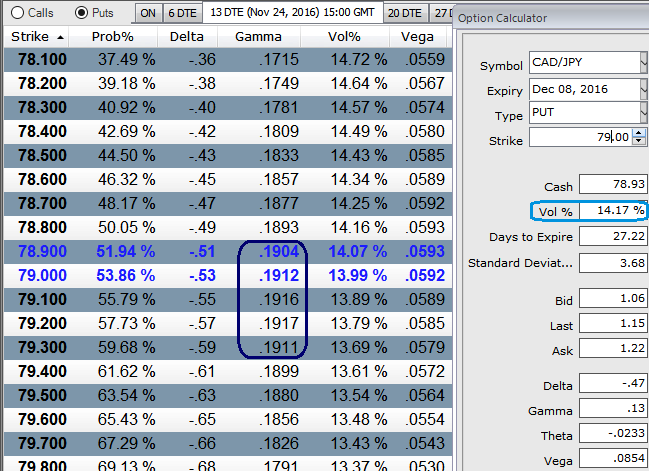

While the implied volatility of 1m CADJPY ATM contracts are spiking higher 14.17% tenors.

3-Way Options straddle versus Call

Spread ratio: (Long 1: Long 1: Short 1)

Rationale: Since underlying spot FX is crawling up with mild upswings has the stiff resistance of 79.500 levels, shorting expensive OTM puts with shorter expiries would likely result in positive cash flow on expiration as the pair is testing supply zones and seems unlikely to show dramatic break out above.

On the contrary, we trust pair may move in either direction but capitalizing on steady IVs with no significant data drivers in short run that could bring in considerable IV spikes, Gamma of OTM strikes and corresponding IVs also in sensitivity table are reducing, thus such OTM instruments seem beneficial and deploy in our strategy.

The Execution:

Go long in CADJPY 1M at the money delta put, Go long 1M at the money delta call and simultaneously, Short 2W (1%) out of the money put with positive theta or closer zero.

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data