The markets have been gripped by the ongoing exponential growth in the coronavirus outbreak, the ultimate magnitude and duration of its adverse impact is still highly uncertain because the characteristics of the virus is still unknown.

However, every coin has two sides. This is a common sense, but the market always tends to simply ignore that. The market was hit hard earlier this week by the virus threats, but sentiment were improved noticeably over the past 24 hours, which seems to suggest that the virus risks had been overstated.

Although being technically unware of this virus, wish to emphasize that the rebound in the market was a necessary correction to the earlier massive risk-off. The market will still have to face a lot of uncertainties and need more data to assess the damage on China and the consequent implications on global economic outlook. Hence, we’re inclined to foresee that the concerns will quickly overshadow the short-term optimism.

For USDCNY, we might see some consolidation at around 7.00 for the time being, but it makes more sense to take a bearish view on CNY given the uncertainties ahead.

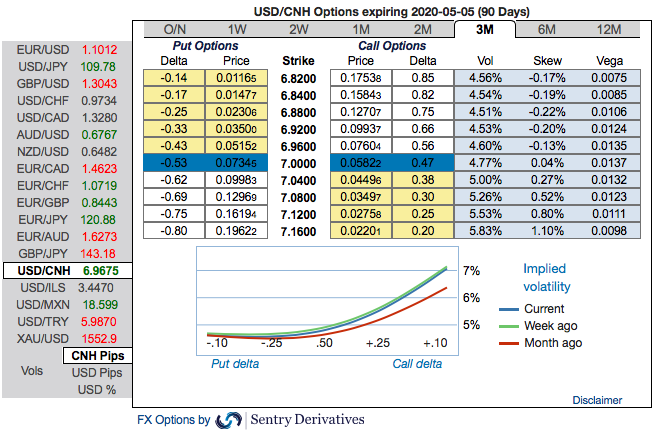

FX vol pricing once more displayed little signs of overreaction to the latest Coronavirus-induced global markets sell-off. Long skews and correlations USD/Asia constructs offer a cheap implementation of Coronavirus hedges in a directional format. In our recent posts, we’ve advocated defensive vol plays via long EURUSD, USDCHF and USDINR delta-hedged riskies combine a natural risk-off sensitivity with an attractive proxy of skew premium and static carry.

For now, please be informed that USDCNH positively skewed IVs of 3m tenors still indicate the upside risks, they are still bids for OTM call strikes up to 7.16 levels.

Contemplating above factors, and organic depreciation pressures likely will take the pair back higher in 2H as domestic growth is expected to moderate and likelihood of further trade deals become difficult with the U.S. election cycle kicks in. Without any meaningful surprise to the scale of tariff rollback down the road, we struggle to see the case for the USDCNY to sustain notably lower than its current tariff neutral range at 6.95-7.20.

Hence, at this juncture, we uphold our shorts in CNH on hedging grounds via 5-month (6.90/7.15) debit call spread. If the scenario outlined above unfolds, we will re-assess our stance but at the moment there are no changes to our CNH recommendations, spot reference: 6.9683 level. Courtesy: Sentry & JPM

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025