The RBA doesn’t seem to have finished cutting interest rates, and markets should refocus on China woes in H2. AUD/USD is lagging the dovish pricing of rates, the technical picture shows vulnerability and long positioning is stretched.

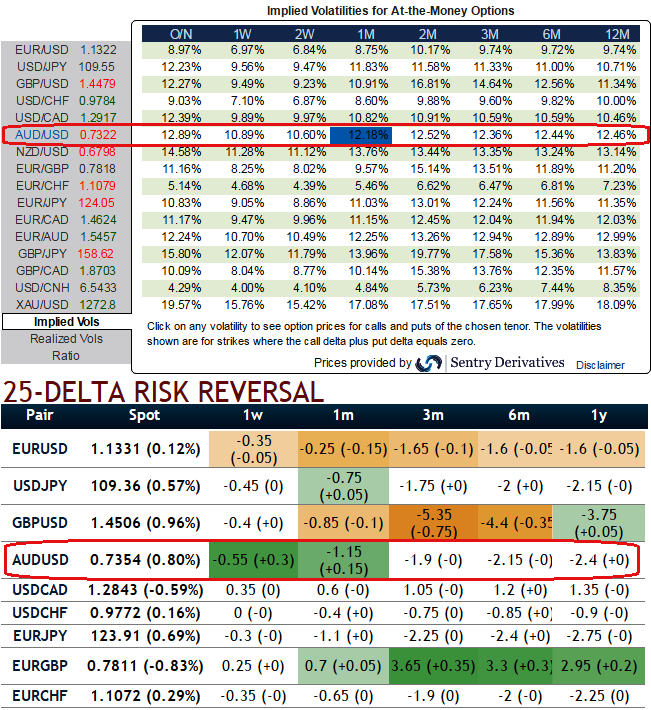

In the volatility space, downside skew is overpriced given the low sensitivity of volatility to spot moves. It suggests selling downside Vega.

Hedging Framework:

Please be aware of IVs of AUD & GBP crosses have been spiking in swift pace over longer period of time, especially for 1m to 1y tenors. In AUDUSD, we could very well observe a new rising hedging positioning for 1m tenors for bearish risks.

The gradual rise over long run could be viewed as better opportunity for options strategies using knock in strikes and narrow expiries.

We recommend Buying a 3m put strike 0.72 with a knock-out set at 0.77, two figures below the year-to date low.

Buy AUD/USD 3m/1m put strike 0.72, knock-out 0.77, indicative offer: 0.60% (vs 2% for the vanilla, spot ref: 0.7334).

Risks associated with trade: AUD/USD falling below year-to-date low within no time. Investors buying a knock-out option cannot lose more than the premium initially invested. The option will however cease to exist if AUD/USD touches 0.77 at any time before the 3m expiry.

The recommendation for buying an AUD/USD 1m put strike 0.72 with a topside knock-in at 0.7770. The option was duly activated as the spot culminated at 0.7828 levels two weeks later before subsequently declining.

Unfortunately, this 1m option expired too early to deliver a positive payoff, as the spot was just above the strike at this time. We think that this is an ideal timing right now to reset bearish AUD positions via options as you can probably understand OTC sentiments of AUDUSD pair through delta risk reversal numbers, since the RBA is not finished making cuts and China woes should undermine confidence too again in H2.

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise