US West Texas Intermediate crude goes up 66 cents at $57.80 a barrel while articulating ahead of EIA’s inventory check today.

The largest UK oil pipeline system, the Forties pipeline, was shut down on Monday to undergo emergency repairs. This disrupted over 400 kb/d of flows planned for December.

Front-month ICE Brent crude prices surged from $63 late Friday/early Monday to nearly $66 early Tuesday, before falling back to $64. While the Forties shutdown has provided a price floor, flat price gains quickly evaporated in a global market that is still oversupplied and with output rising in the United States.

As we enter 2018, this equation should change as producers use swaps for the rest of the year. In terms of pricing, there were more volumes hedged between $49-52/bbl WTI, Exhibit 8, followed by slightly lower volumes hedged between $52-55/bbl. Limited volumes were hedged around $55-57/bbl levels.

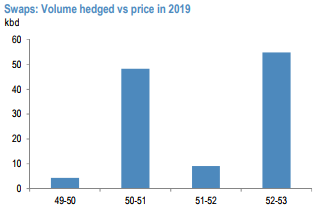

This clearly is interesting to note as producers were very comfortable around the lower 50’s to hedge. For 2019, producers hedged mostly in the lower 50’s range once again (refer above diagram).

Additionally given the volumes hedged is significantly lower in 2019, producers would rather wait and watch and layer in when oil prices get supported intermittently. There is also a trend of smaller producers hedging at slightly lower price levels than the large caps for both 2018 and 2019 but that is still a marginal difference.

However despite higher hedges in place which might pose risk to oil markets as US producers are typically expected to add more oil on the back of hedged volumes, can they and will they add the extra barrels significantly on top of the hedged barrels which are not typically hedged? We take a look at both upside and downside risks to US upstream production.

Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data