Eurozone ‘flash’ CPI inflation for June is forecasted to edge up to 2.0% from 1.9%; US data are expected to show robust growth in personal spending.

Gold strength vs EUR weakness via call spreads: Even following the recent bounce the back end XAUEUR vols are only 1 vol from the multi-decade low.

While somewhat scepticism still lingers on the resilience of the euroarea inflation outlook, as especially domestically generated price pressures remain muted. Hence, we expect the ECB to stick to its mantra and remain patient, prudent and persistent.

While inflation is moving in the right direction, further growth deterioration may delay the ECB's next steps.

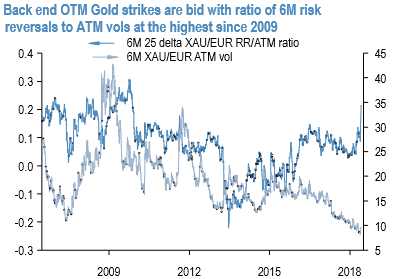

Reminiscent of poor EUR sentiment topside OTM Gold strikes got bid to the highest level since 2009 (in terms of the ratio of 6M risk reversals to ATM vols) (refer 1st chart).

This setup helps economize bullish Gold play while hedging EUR risk and is supportive of call spreads that sell overpriced OTM strikes to cheapen already cheap ATM strikes.

At 220bp XAU, 6M ATM/25D XAUEUR call spreads are the cheapest in more than a decade (refer 2nd chart).

Hence, we recommend 6M XAUEUR call spread (strikes 1115/1165) that costs 135bp XAU, at 3X leverage and 49% discount to outright vanilla. Courtesy: JPM

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes