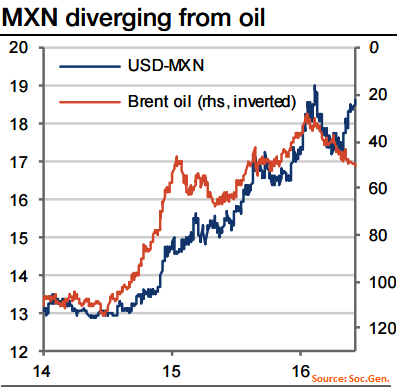

The connection between crude oil prices and EM currencies has been elevated over the past few years, but the relationship is starting to significantly weaken.

It is quite likely that the oil-FX correlation continues to plunge. Indeed, the expectation from brent oil to finish the year at $50/bbl and we anticipate EM FX spot rates to be weaker including USDMXN at around 18 levels by Q3 end but extended gains to retest the peaks of 19.4450 levels. The correlation breakdown is most striking in the MXN.

Oil prices have been creeping higher during May, but USD-MXN has skyrocketed by 10% and is showing no signs of letting up. In an attempt to capture the re-coupling of FX to oil, we went long MXN-RUB on May 18.

The entry point was favourable (basically the lows) so the trade is slightly in the money (+50bp), but the upward march in USDMXN is worrying against stable-to-rising oil prices.

MXN among few EM currency space typically held in carry basket seem cheap on a real effective exchange rate basis, at spot reference 18.69, short 1M USD/MXN (1.5%) OTM puts vs longs in 2M ATM 0.5 delta calls, use European style options, while going long in near month WTI futures to mitigate further upside risks.

1M ATM implied volatility of USDMXN is perceived to be at 12.50% and it is likely to smoothen in 2m tenors. With steady volatility gamma adds to the considerable risk and reward profile for both holders and writers.

Thus, on a hedging perspective amid speculation on Fed's hiking cycle, use gamma factor in consideration to neutralize volatility while formulating positions.

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary