USD seems to be little vulnerable in the short-run on risk sentiments ahead of NFP that is scheduled for this Friday. Ahead of the US labor market numbers tomorrow, watch for evolving Sino-US headlines and ECB meeting minutes for further cues. ECB’s monetary policy is also scheduled for the next week.

For today, expect investors to trade on the ebb and flow of risk appetite developments, with the global data flow and the equity complex also supportive of risk-taking behavior.

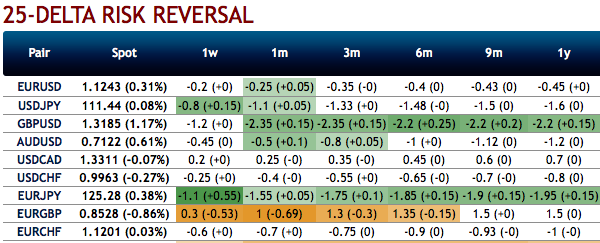

In a nutshell, the USD may remain slightly wobbly, with short-end riskies have also been leaning slightly against the USD in G7 space.

EURUSD’s upswings are observed from last 2-3 days in a row ever since it has jumped from the lows of 1.1183 levels. However, the interim upswings unlikely to sustain in the long-run. We emphasized this bearish stance even in our technical section.

Most importantly, the FX OTC hedging markets are also suggesting the same thing, the IVs and risk reversals of the short tenors indicate interim rallies but the major bearish hedging sentiment remain intact.

Hedge USD-denominated income via risk reversals (RRs): The bearish neutral RRs across all tenors have still been signaling downside risks.

3m positively skewed IVs are in line with the above-stated bearish scenarios. Skews stretched towards OTM put strikes signifies hedgers interest in the further bearish risks.

We see potential further USD strength and limited risk of significant USD weakening in the short-run, and notably, our EURUSD forecast is now running close to forwards on all horizons (vs previously above) and across tenors.

As a result, we recommend hedging USD-denominated income via risk reversals: this allows one to profit from some dollar strength near term (as per our call), yet still secures a worst-case rate without locking in the negative carry from the outset.

Any skepticism for the upside risks in the minor trend could be arrested by deploying 3m 1% in the money puts with attractive delta. Thereby, if you buy in the money put option, on hedging grounds, with a very strong delta will move in tandem with the underlying.Courtesy: Sentrix & Saxo

Currency Strength Index: FxWirePro's hourly EUR spot index is inching towards 25 levels (which is mildly bullish), while hourly USD spot index was at 4 (neutral) while articulating (at 10:47 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes