CHF appreciated ahead of the Brexit referendum, and EURCHF has, except for referendum-day volatility, been trading in a 1.08-1.095 range in July.

SNB confirmed interventions during referendum night, seeing FX reserves rising in June.

Swiss interest rates remain lower than pre-Brexit levels, and the entire gov’t curve is yielding negative rates, except the 50y. Money market rates indicate 40% probability of an 25bp cut at the next meeting 15 Sep. - Forecast: 1.07, 1.07 and 1.12 in 1,3 and 12 months.

Short term risk sentiment will continue to pose appreciation pressures. SNB likely to remain active - Despite the real economy and inflation still under pressure from the appreciation of the CHF, the currency remains heavily overvalued. Fundamentals still points to a weaker CHF. - While expecting the ECB to continue APP, we do not expect the SNB to have to lower interest rates - Foreign appetite for CHF assets has abated. The negative interest rates are likely to push Swiss investors to invest more abroad, once global market sentiment improves.

OTC updates and Hedging Strategy:

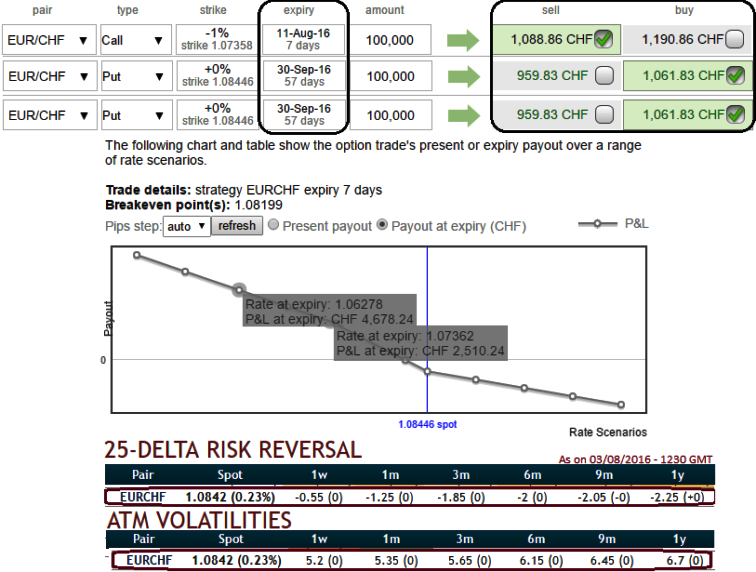

Please be informed that the implied volatilities of EURCHF ATM contracts of all expiries have been the least among G10 currency segment.

While, the 25-delta risk of reversal of EURCHF has also not been indicating any dramatic shoot up nor any slumps, but seems to be one of the pairs to be hedged for downside risks as it indicates puts have been relatively costlier.

Considering the pair’s non-directional technical trend that’s been long lasting but slightly bias towards downside and risk reversal also signals bearish pressures, it is deemed as the directional swinging southwards, so writing a mid-month (2%) in the money calls and simultaneously, long in at the money put of far month expiry would optimally hedge the FX risks.

To hedge long term bearish risks we’ve chosen 2m ITM longs in puts that would save your spot FX payable exposure if any would be protected on account of potential dips in this pair. The initial credit received for this trade would reduce the cost of hedging.

Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts