Iron ore, which is the most important ingredient in steel making has reentered the bull market once again driven by Chinese demand and Chinese mills replenishing inventories. Iron ore with 62 percent iron content delivered to Qingdao is up 21.3 percent since the low of $53.36 a ton seen on June 13. Trading of the steel-making ingredient rose 3.8 percent to $64.71 per ton in China on Thursday, hitting a two-month high. The price of the metal is up 14 percent for the week so far. The change in market direction is considered when price either rises from bottom or declines by 20 percent from the peak.

Iron ore had declined sharply from its March peak around $90 per ton, as the hopes of quick infrastructure push in the United States under the Trump administration evaporated. Price declined more than 40 percent to reach the above-mentioned bottom in June.

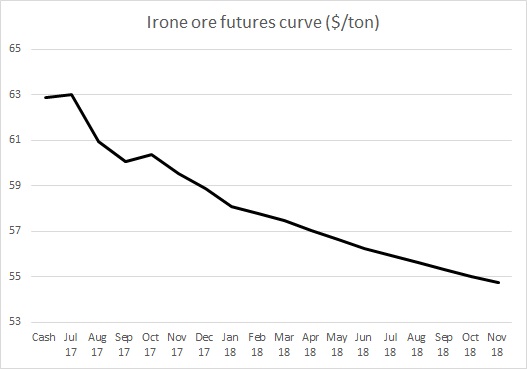

However, one must note that the Iron market, as shown in the curve remains in backwardation, which is indicating a greater demand in the physical market, while the market is not concerned about future supplies.

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed