Chinese yuan has been gaining considerably from the last couple of days. USDCNY seems to have stabilized somewhat below the 7.10 mark for now. By and large, the market has returned to where it was before the Hong Kong issue. Again, US-China relations are the key factor influencing the CNY exchange rates, but it appears that both sides have taken a step back for the time being, while the overall tone remains hostile. In the meantime, the CNY exchange rates followed the recent risk-on mode across EM markets, re-gaining the losses since the Hong Kong issue.

Moreover, China's inflation momentum has been slowing significantly, with CPI falling dramatically over the past few months. Economists have started to talk about deflation risks looming on the horizon, which means that the consumer demand will remain soft in the future. Hence, there seems little endogenous factor that could drive CNY stronger.

In the FX market, CNY simply ignored the seemingly negative headline reserve data, and rallied against the overall risk-on sentiment, with USDCNY below 7.05 mark.

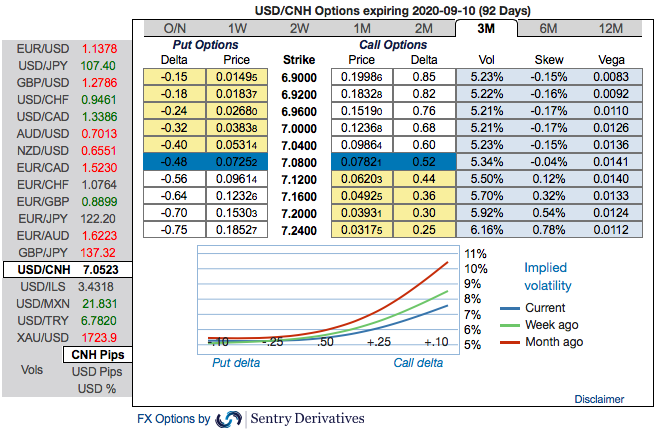

Please be informed that the positively skewed USDCNH IVs of 3m tenors still indicate the upside risks, they are still bids for OTM call strikes up to 7.24 levels.

Hence, at this juncture, we uphold our shorts in CNH on hedging grounds via 3-month (7.00/7.25) debit call spread. If the scenario outlined above unfolds, we will re-assess our stance but at the moment there are no changes to our CNH recommendations. Courtesy: Sentry & Commerzbank

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty