CAD risk skewing positive, as BoC dovish stance bending, though not yet breaking:

Ongoing data surprises mean forecast upgrades forthcoming in next week’s Monetary Policy Report. The data flow from Canada, similar to what has been seen globally, has surprised almost persistently since last September (refer above diagram). Our economists have raised their own 1Q GDP growth forecast to 3.8% and have penciled a first BoC’s hike in 3Q18. BoC will likely have to make similar upside revision both global and its own Canada forecasts –the January MPR it estimated 4Q16 and 1Q17 at 1.6% and 1.5%yoy respectively compared to an actual 2% in 4Q and a January 2.3% print (refer above diagram). Meanwhile, BoC's 1Q17 projection for headline inflation was 1.8% versus actual inflation in first two months of the year which averaged 2.0%.

But this is unlikely to shift BoC away from its dovish stance. This begs the question whether the forthcoming forecast upgrades will shift the BoC stance in a meaningful way for CAD; we think unlikely, in the near-term at least. First, is simply the stubborn dovish persistent rhetoric over the past month from BoC Gov Poloz and other senior officials, as recently as last week downplaying the strength of recent headline data, emphasizing still-sizable excess capacity, downside risks, and warning against expectations that BoC would mirror the Fed in the US’s policy normalization cycle.

Below the surface of the headline data, BoC’s dovish stance still has solid legs to stand on. The view of ongoing slack is reinforced by ongoing weakness in both core inflation numbers -which has been persistently running round 0.4%-pts below the 2% target, as well as trend-weakening seen in wage data, inclusive of today’s payrolls report showing the slowest average hourly earnings growth on record. Moreover, the foundation of BoC’s unusually cautious view is an observation that the non-commodity export sector is suffering from competitiveness issues from an incomplete rebalancing.

OTC updates and hedging framework:

The main reason behind this decision is that the BoE would not want to add any extra strain on the markets and the British economy in conjunction with the Brexit apprehensions by allowing any speculation about an adjustment of its monetary policy.

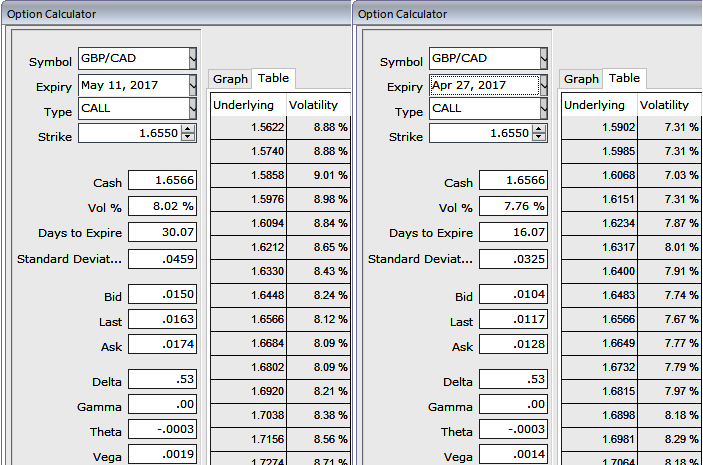

Please note that in OTC markets, the IVs of this pair is just shy above 8% and a tad below 7.8% for 1m and 2w tenors respectively.

These ATM IVs seem to be quite on the edge to factor in the weakness in this pair as we could see the reasonable increase in IVs of 2W and 1M tenors. As a result, we recommend capitalizing on the sustainable IV factor by employing ITM short puts as their central bank's decision was also in line with market's expectations and matching this with ATM longs to construct short-term back spreads that is likely to fetch positive cash flows as per the indications by sensitivity table.

When trying to assess how a spread may perform, looking at the 2m IV skews spreads of out of the money option shorts for an indication of relative option prices seem attractive.

So, keeping all these attributes in mind here goes the strategy, go long in 1M 2 lots of ATM -0.50 delta put, and in 2M (1%) OTM -0.36 delta puts while shorting 1 lot of ITM put (0.5%) put with 2-week expiries.

Subsequently, the slight upward or sideway swings would derive the positive cashflows through the initial receipts of shorts which could be utilized for reducing hedging cost.

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate