EURUSD’s downside risks point to parity and lower, the unlimited QE means the US has a ready buyer for the huge pipeline of Treasury debt issuance, reducing the need for a higher risk premium or weaker USD. Low inflation is also benefitting the dollar.

Unless the euro area addresses the challenges facing its fiscally weaker members, or it starts to repatriate its stock of net foreign assets, we see the path of euro depreciation extending.

Hence, we have downgraded EURUSD forecasts and anticipate a test of parity in coming months. However, if Brussels cannot alleviate the fiscal straightjacket facing the EA’s more fiscally challenged economies, the risks of a deeper decline in the euro will open up.

EURUSD risks breaking below the 1.05 support area: Over its 21-year history, EURUSD has traded in a broad 0.80 – 1.60 range. Whereas, since 2015, 1.05 has been a good support level, having closed below that on only 15 trading days in that time.

Overall, the swift paced, rollercoaster ride that has been the EURUSD in 2020, is approaching this critical 1.05 area.

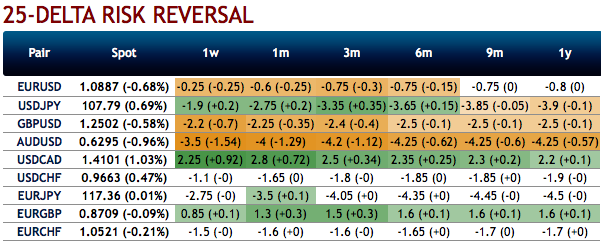

OTC Outlook: EUR risk reversals have indicated the mounting hedging sentiments for the bearish risks as the fresh negative bids are observed (1st chart).

Most importantly, the positively skewed EURUSD IVs of 3m tenors are stretched on either sides but with slight biasness towards downside hedging risks (refer 2nd chart).

Hence, considering all these factors, the below options strategies are advocated, we now wish to uphold the same strategies.

Options Strategy: Contemplating above factors, initiated long in 2 lots of EURUSD at the money -0.49 delta put options of 3M tenors, write an (1%) out of the money put option of 2w tenors, (spot reference: 1.0880 levelß). Short-legs go worthless as the underlying spot price hasn’t gone anywhere. Any slumps from here onwards are to be arrested by the 2 lots of ATM long-legs.

Those who are sceptic about mild rallies, 3m 1% in the money puts with attractive delta are advised on a hedging ground. Thereby, in the money put option with a very strong delta will move in tandem with the underlying.

Those who want to participate in the prevailing rallies in the short run, one can freshly initiate the strategy. The directional implementation of the same trading theme by further allow for a correlation-induced discount in the options trading also if you choose strikes appropriately. Courtesy: Sentry, ANZ & Saxo

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch