Among the three bearish drivers of FX in March economic fallout from COVID-19, oil price war and poor liquidity only one has abated (oil).

The weak fundamentals keep us cautious in FX. Growth forecasts are still getting downgraded, even though new infections have peaked in DM. FX markets remain asymmetric to vol shocks.

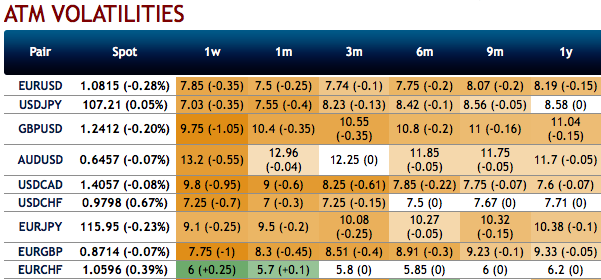

ATM IVs (implied volatilities) of G10 FX-bloc has again been dipping (refer above nutshell), the sharp reversal in the VXY in April series has left it screening 0.5 - 1.5 pts. cheap vs. cyclical correlates, which is hard to justify in a climate of worsening growth, elevated oil / commodity volatility and political tails risks in Europe and China.

GBP, Scandi FX downgraded as you could observe the negative bids for the existing bullish risk reversals, while euro crosses see upside hedging and CAD also sees upside hedging sentiments.

Mid-curve USDCAD vols screen cheap despite the dramatic sell-off in oil this week. Buy USD call/CAD put one-touch calendar spreads with premium rebate as a carry-positive, leveraged forward volatility play.

The increase in hawkish rhetoric of late out of the US around China in the context of COVID-19 risks another flare-up in US/China tensions. Buy low and flat CNH 6M6M forward volatility (FVA) as a hedge, which has the added benefit of offering pre- vs. post event exposure around the US elections in November. Courtesy: JPM & Saxo

Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics