At the start of the FOMC meeting the US central bankers are experiencing strong headwinds for their rate hike plans. This time round mainly from the US President who took another swing at the Fed yesterday. It was “incredible” that it was “even considering” hiking interest rates further. Of course, he was backed by his closest advisors. According to his trade advisor, Peter Navarro, the Fed should act in a more data dependent manner. And the argument that the Fed had to hike interest rates to prove its independence would as well be unjustified.

First of all: if the administration did not attack the Fed’s approach in such an open manner the Fed would not be in the situation in the first place where it has to defend its independence.

Secondly: yes, a rate hike to demonstrate its independence is exactly the right step in this situation. The resilience and stability of a currency depends directly on the strength of the institutions that back it. The best negative example this year was Turkey.

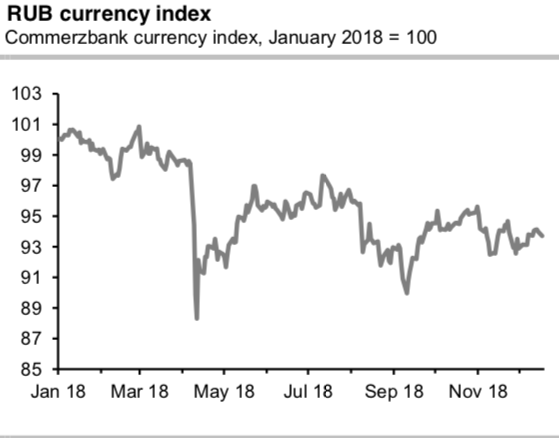

The best positive example: Russia. Shortly after the Russian Premier voiced his support for lower interest rates the Russian central bank hiked key rates in a surprise move. It surprised the market again with another rate hike just a while ago. By doing so, the bank leaves no doubt what its priorities are.

As a result, the Russian currency has stood up impressively well this year (Refer above chart) – despite geopolitical tensions, Emerging Market turbulence and a continued weak economy.

Resumption of FX purchases will prove bearish for RUB, in our view. The CBR announced resumption of FX purchases from January 15th. This is likely to weigh meaningfully on RUB, in our view. The currency has struggled to appreciate while purchases were suspended and the full current account surplus was allowed to support the FX market. With FX purchases in place, the current account support will be much smaller.

Meanwhile, recurring geopolitical tensions are likely to weigh on capital flows. Notably, the central bank now indicated that any future RUB weakness is much less likely to be met with renewed suspension of the program. This, in our view, both increases the scope for depreciation in RUB as well as the chances CBR will deliver more hikes.

Trade recommendations:

RUB: We maintain our 11-January-2019 1x1 USDRUB (68/71) call spread. We may have been a bit early with this trade as the resumption of purchases was now announced only for January 15th, after the expiry of our option. Yet, amid global EM risks and negative RUB seasonality around the year-end, we still see a good chance RUB will weaken in anticipation of the budget rule headwind within the remaining maturity of the trade.

TRY: At spot reference: 5.3393 levels, contemplating above driving factors, on hedging grounds we would like to uphold RV trades - 3m USDTRY put up-and-in Short 1m put.

Currency Strength Index: FxWirePro's hourly USD spot index is flashing at -77 levels (which is bearish), while articulating at (12:53 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch