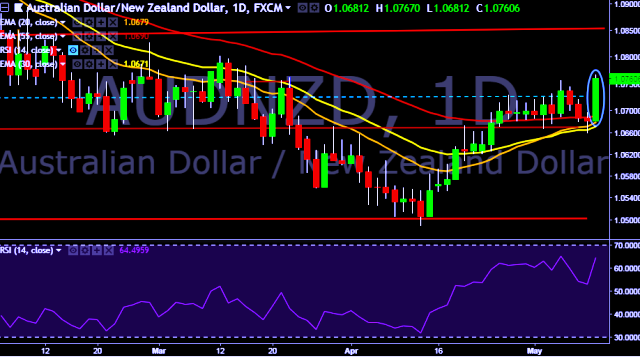

- AUD/NZD is currently trading around 1.0768 marks.

- Pair made intraday high at 1.0777 and low at 1.0681 marks.

- Intraday bias remains bullish till the time pair holds key support at 1.0658 mark.

- A sustained close above 1.0681 will drag the parity higher towards key resistances at 1.0802/1.0945/1.1072 levels respectively.

- Alternatively, a daily close below 1.0681 will take the parity down towards key supports around 1.0620/1.0572/1.0506/1.0443/1.0380/1.0305 marks respectively.

- Important to note here that 20D, 30D and 55D EMA heads down and confirms the bearish trend in a daily chart.

- New Zealand cash rate stays flat at 1.75 % (forecast 1.75 %) vs previous 1.75 %.

- RBNZ sees official cash rate at 1.8 pct in September 2018 (previous 1.8 pct).

- RBNZ says expect to keep ocr at this expansionary level for a considerable period of time.

- RBNZ makes no mention of NZ dollar in statement.

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest